Crypto Market Crash: Causes and Impact Explained

Target Keyword: Did Crypto Crash? Market Losses Explained

Introduction

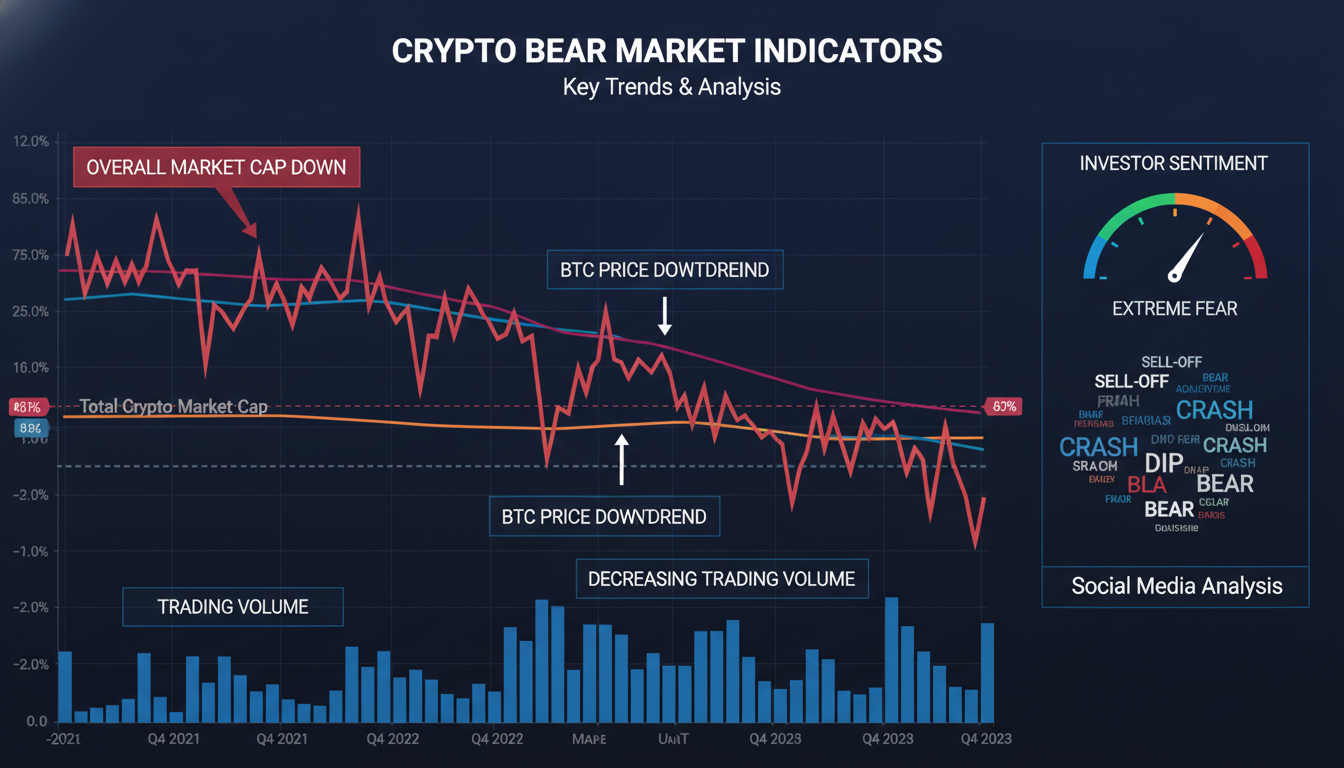

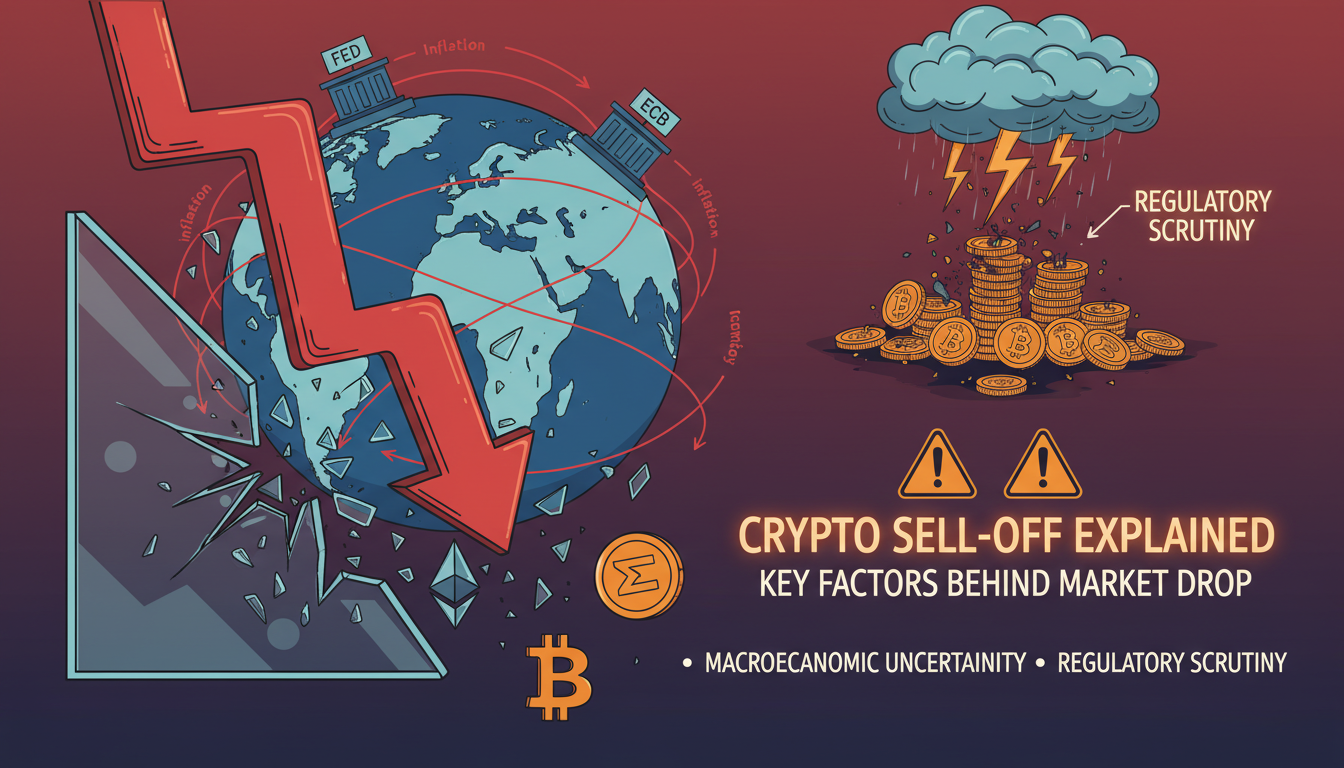

Yes — crypto did crash, and the recent market losses shook many investors deeply. The main trigger was a wave of negative sentiment, driven by rising regulatory pressure and shaky macroeconomic signals. Prices tumbled across major coins, wiping out billions in market value within a short span, and dragging on confidence even now.

What Actually Happened to Crypto Markets

Bitcoin and other major cryptocurrencies dropped noticeably over the past weeks. Sharp declines followed key regulatory announcements and global economic jitters. Investors rushed for safety, turning to stablecoins and fiat holdings. And as liquidity thinned, even modest sell-offs magnified the fall.

On top of that, major altcoins followed Bitcoin down. Ethereum, for instance, slid hard after tensions in the smart-contract and staking space mounted.

Regulatory Pressure Intensifies

Sudden threats of stricter regulation long warned, but now they materialized. Governments signaled tighter rules on exchanges and taxes. Some proposed limiting crypto firms’ operations outright. Market participants grew nervous — with each mention of regulation, prices slumped.

Macroeconomic Headwinds

Simultaneously, global indicators turned weak. Inflation stayed sticky. Central banks hinted at keeping rates higher for longer. Investors, already skittish, became unwilling to hold high-risk assets like crypto. Cash and bonds reclaimed interest.

Deeper Dive: Causes at Work

Let’s break down the factors more clearly.

Market Sentiment and Psychology

Crypto is notoriously sentiment-driven. When fear sets in, it becomes self-reinforcing. A few high-profile liquidations or bankruptcies spark broader panic. Social media amplifies it — every trending post pushes more people to bail.

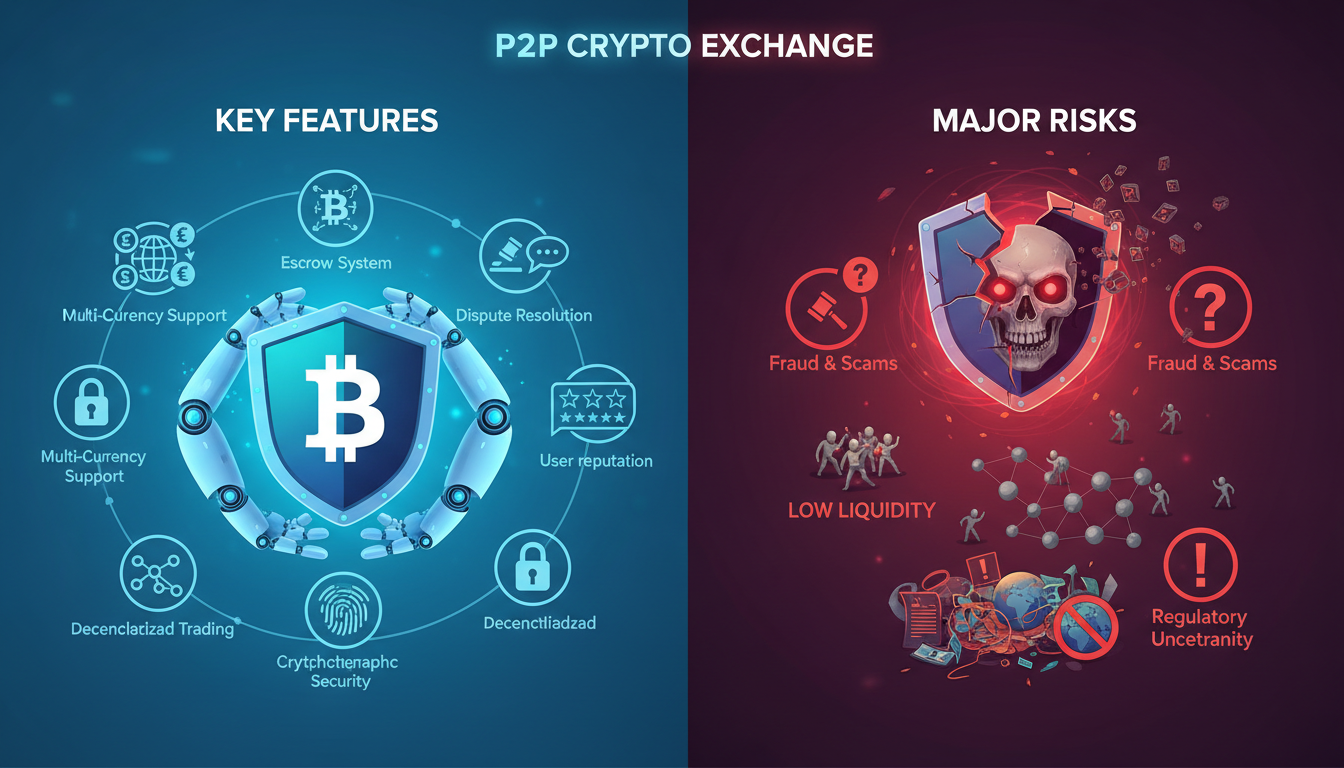

Liquidity Constraints and Domino Effects

Markets thinned out. With fewer buyers around, even small sells cause big price swings. That’s exactly what happened when altcoins sold off. One forced sale cascaded through the system, dragging others with it.

Institutional Moves and Whale Activity

Some big players pulled funds fast. Institutions faced margin calls and exited positions. Meanwhile, whales — big holders — might’ve dumped coins to balance portfolios or hedge risks. That fed the downward spiral further.

Real-World Examples

Consider the last two major drops:

– One followed leaked regulatory guidance from a major EU body. Prices dropped nearly double digits in hours.

– Another followed corporate earnings surprises and central bank comments, flipping investor mood fast.

Even seasoned traders stumbled. Many who once rode up trends now scrambled to manage losses.

What This Means for Investors

In short, the crash underscores crypto’s volatility. It should remind everyone: diversification matters. Holding only crypto can be a wild ride — risk management is essential.

It also raises the question: is this just a correction or part of a wider secular shift? Answering that depends on evolving policy, macro outlooks, and industry adaptation.

“Sharp drops like this are painful but also a sign of market maturing — as long as underlying infrastructure grows stronger,” says an industry analyst.

Such crashes test resilience. Networks, exchanges, and custodians get real stress tests when things go south. Failures now expose weaknesses that must be fixed.

Preventing Next Crashes — What’s Changing

The industry isn’t standing still. Here’s what’s in motion:

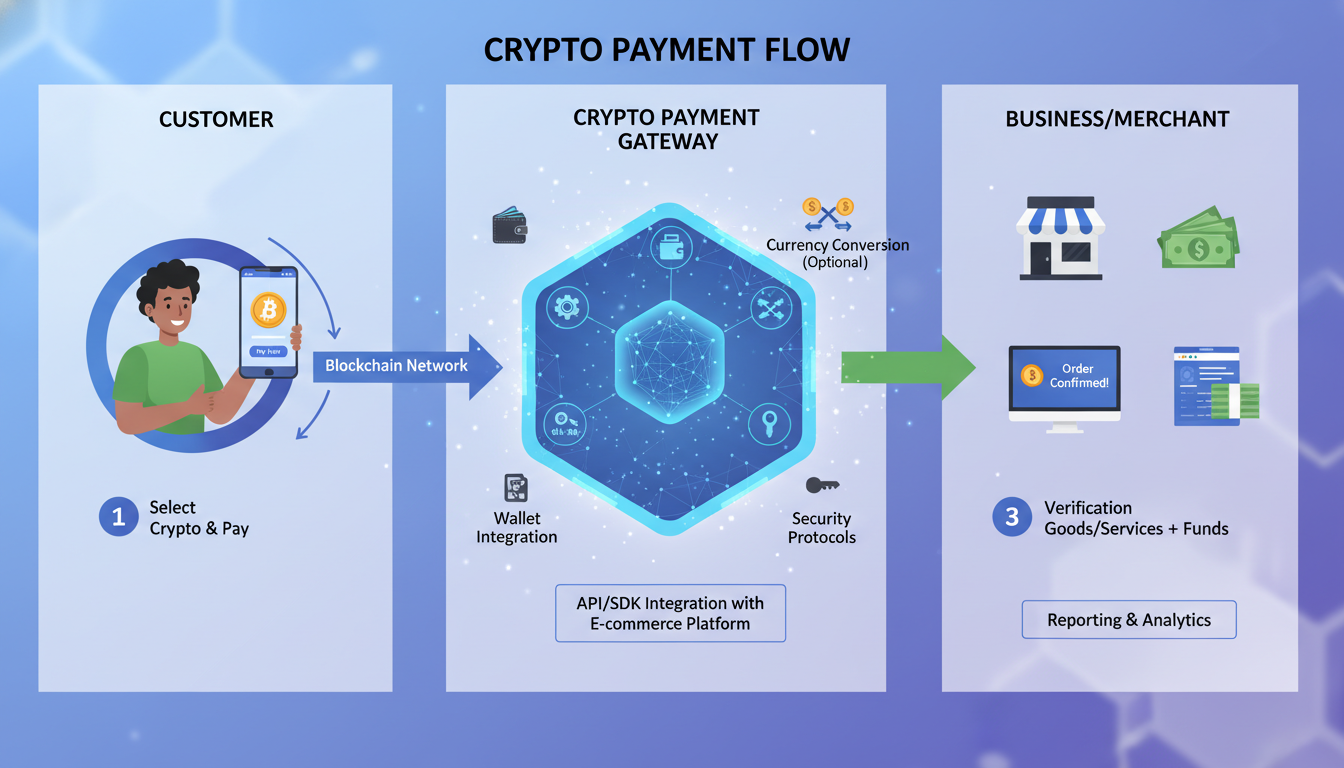

- Exchanges and custodians working on better risk controls and liquidity buffers.

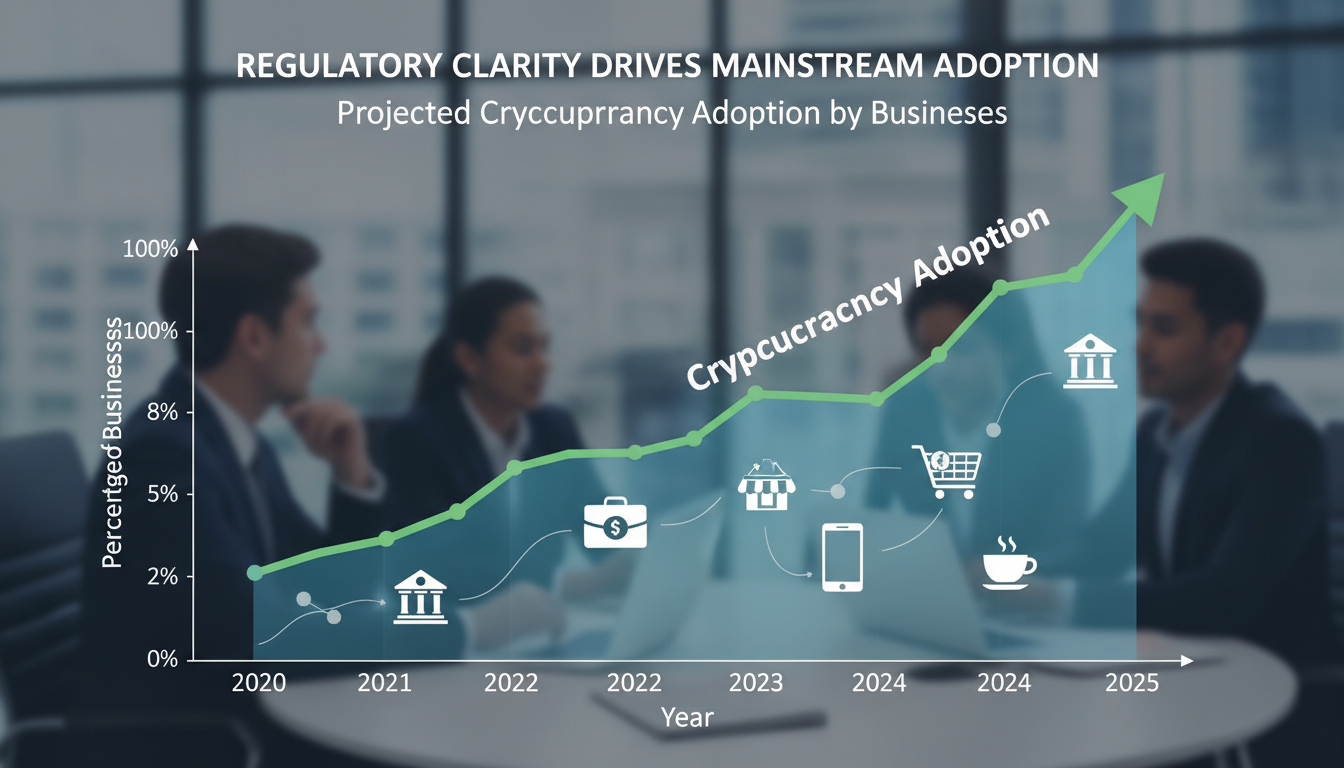

- Some regulatory clarity emerging, helping markets anticipate rules rather than react.

- Growing adoption of on-chain analytics to spot systemic risks early.

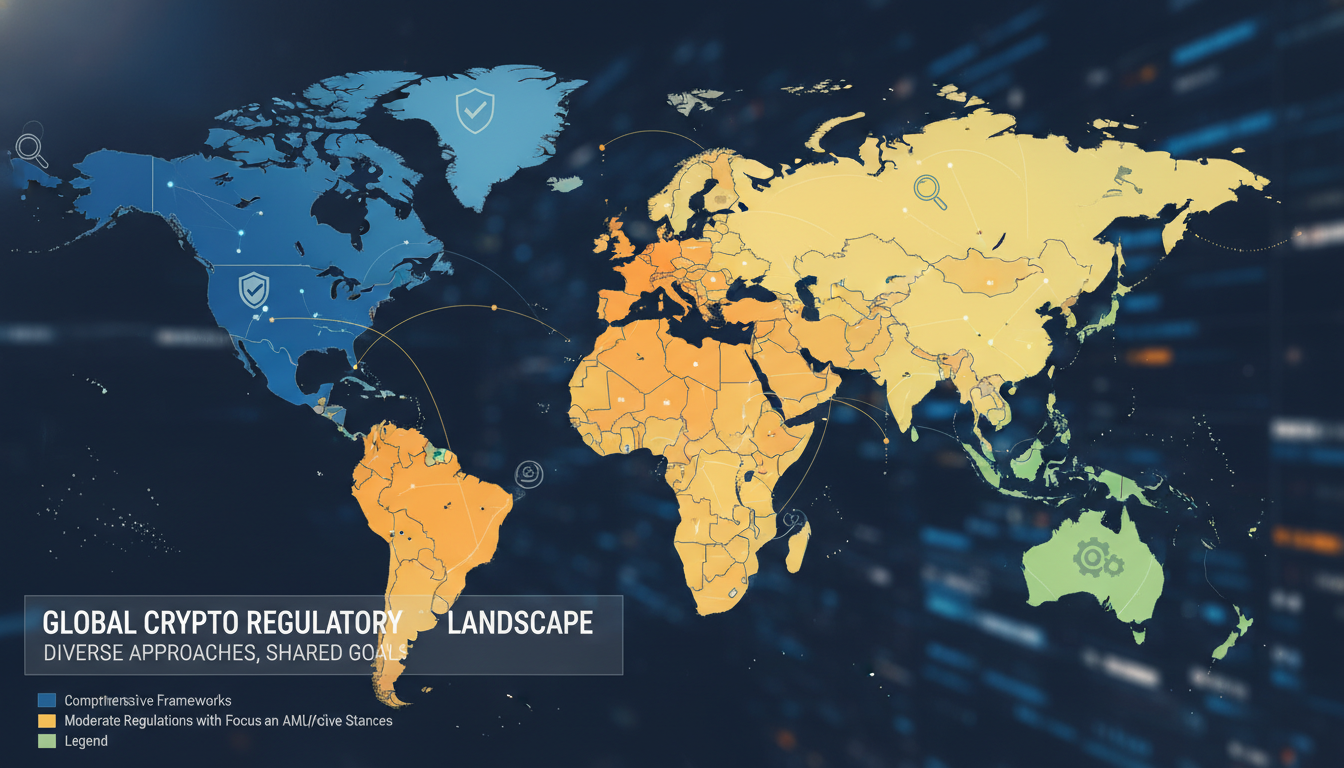

But it’s still a patchwork. The lack of global crypto regulation coordination remains a major vulnerability.

Looking Ahead: Recovery or More Volatility?

Recovery may follow if central banks soften rhetoric and regulators clarify policy. In those scenarios, bullish narratives might return.

Yet, without stronger fundamentals—like scalable technology, sustainable business models, and global regulatory alignment—volatility is likely here to stay.

Conclusion

The recent crypto crash came from a mix of regulatory fears, macro economic stress, fragile sentiment, and shallow liquidity. It exposed how quickly losses can multiply when confidence fades. But it also spotlights areas for maturity — better risk infrastructure, clearer rules, smarter analytics. Going forward, the path depends on how the industry adapts.

FAQs

Did crypto crash completely or just declined?

Crypto didn’t vanish — but it declined sharply. Major coins lost significant value quickly, though some stabilized later. The overall market roared back only partially.

What triggers such crashes?

They usually start with sentiment shifts. A mix of regulatory news, economic worries, and big sell-offs can spark panic. As prices fall and buyers vanish, even small sales cause outsized drops.

Which coins were hit hardest?

High-liquidity coins like Bitcoin and Ethereum led the drop. Lower-cap, riskier altcoins often fell hardest, as they lack the demand buffer that bigger tokens have.

Will regulation prevent future crashes?

Better regulation may help lessen panic. But it depends on clarity and execution. Poorly designed rules could backfire by stalling innovation or spooking markets further.

How should investors react now?

Keeping calm matters. Review your diversification and risk tolerance. If you’re long-term inclined, dips might offer opportunities — but only within a balanced portfolio.