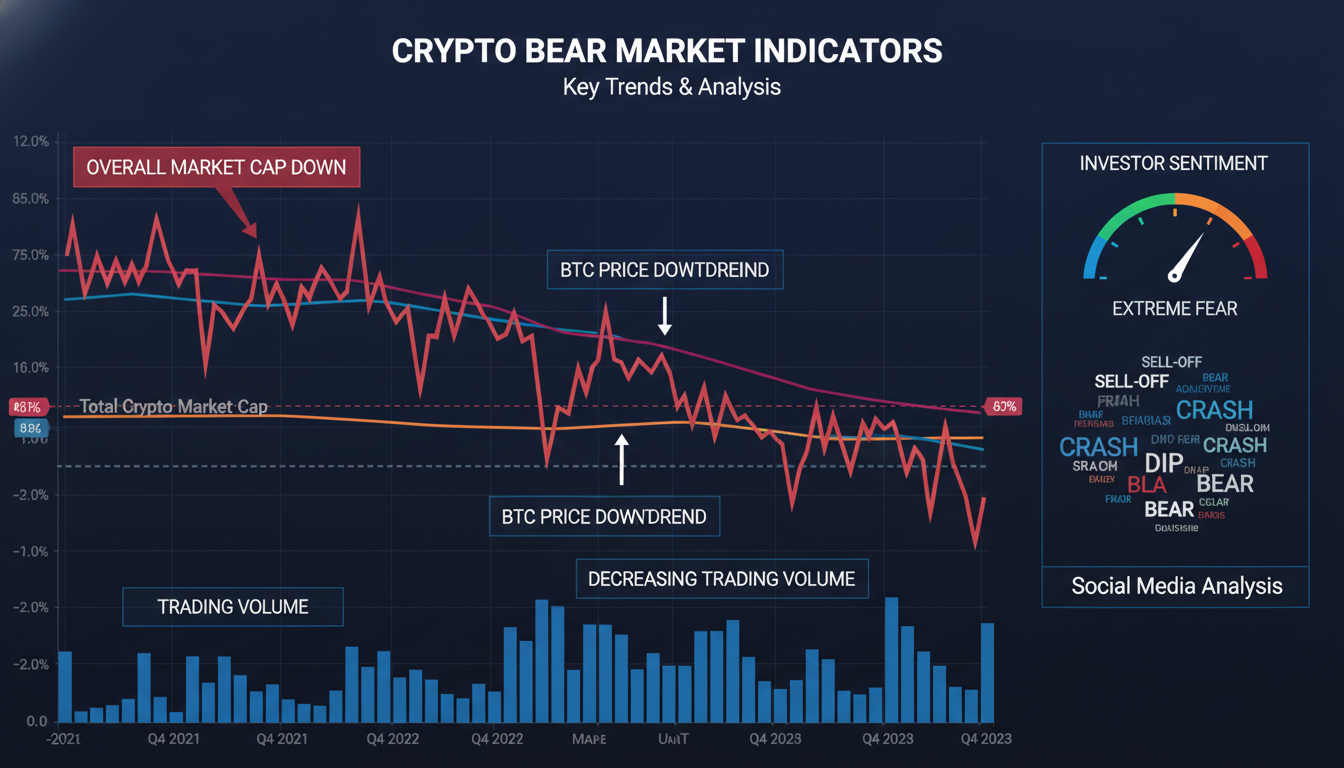

The crypto bull run isn’t definitively over—but markets are definitely showing signs of cooling. Prices are lower than the highs of late 2021, and some momentum indicators are fading. That doesn’t mean the rally is dead—cycles don’t end overnight. The market is simply shifting gears, and understanding where we are in the broader cycle can help investors spot what’s next.

Spotting the Turn: Market Cycle Basics

Every crypto bull run goes through phases—too often we zero in on the big spikes and ignore what follows. Typically, you’ll see:

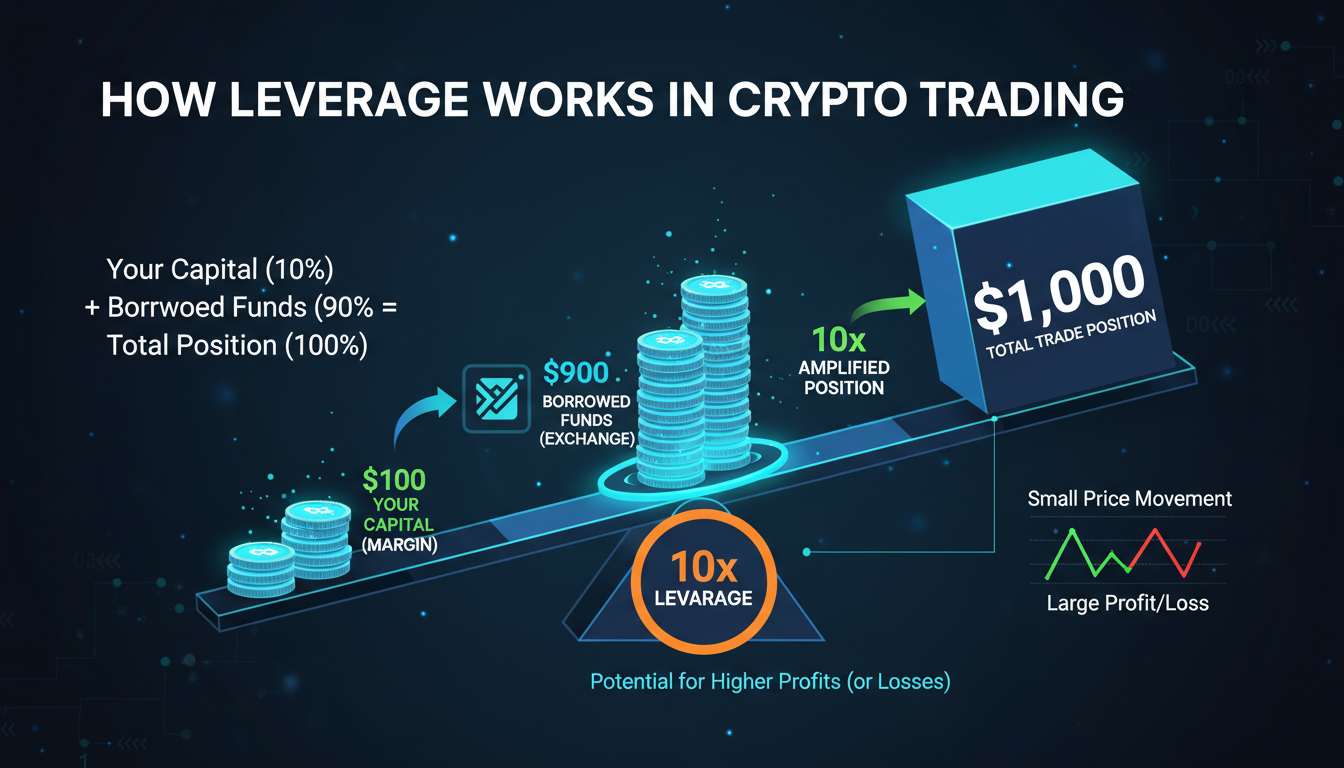

- A leverage-fueled rally, driven by hype and new entrants.

- A peak of euphoria, when prices seem unstoppable.

- A correction or consolidation, where confidence wavers.

- A base-building phase, setting up the next move.

Right now? It feels like we’re somewhere between correction and base-building. Bitcoin and Ethereum have pulled back noticeably. Trading volumes are muted. But this could just be the market gathering strength before another upward stretch. In short, the bull run may not be over—it’s just shifted.

Why It Feels Like the Bull Might Be Over

1. Price Pullbacks and Volatility

Price action has been choppy. After record highs, both Bitcoin and Ethereum dropped into weaker levels. That sudden drop shakes confidence—traders get jittery, some sell off. But volatility can also lure in fresh traders looking for bargains.

2. Momentum Indicators Cooling

Indicators like RSI and moving averages suggest overbought conditions are easing. With rates still sticky and general macro pressure, momentum has slowed. Still, reduced momentum might just mean we’re consolidating.

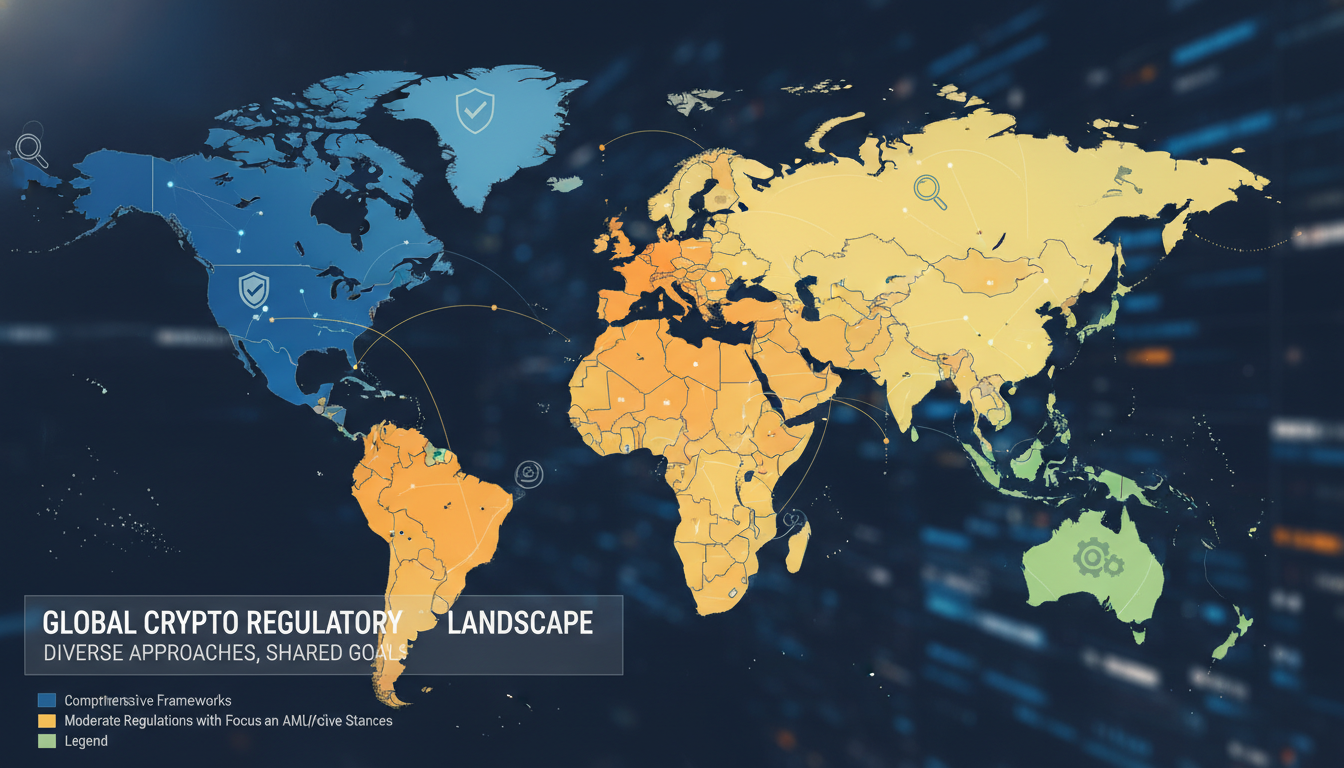

3. Macro Factors and Liquidity

Interest rate talk, central bank policy, and global unrest are putting pressure on speculative assets like crypto. Easy money helped fuel the bull run, and now tighter liquidity could be weighing on it. Or maybe it’s just a temporary squeeze as capital finds new paths.

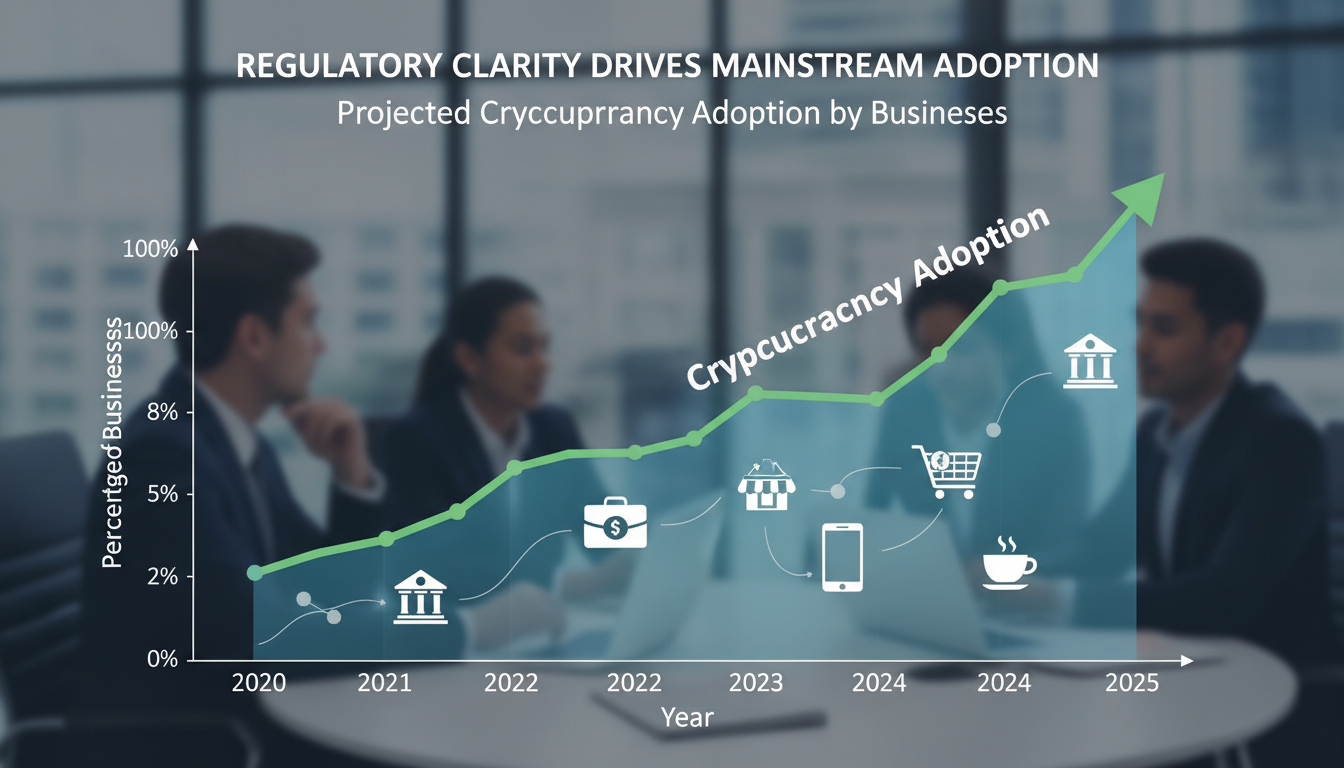

Why Some Think We Haven’t Fully Hit a Bear Market Yet

Many bear markets see deeper and more protracted price drops. That’s not happening so far. We haven’t seen widespread capitulation or extended lows. There’s still buying activity at higher levels than last cycle’s bottom. Large holders aren’t dumping en masse. That suggests base-building, not breakdown.

Real-World Example: Post-2017 Crypto Cycle

After the 2017 peak, Bitcoin fell hard in 2018. But in 2019, sideways movement dominated before a new rally started. We may be seeing a repeat: an uncomfortable pause that soon gives way to renewed confidence.

What’s Next? Reading the Signals

Support and Resistance Zones

Watch how price holds at key support levels. If Bitcoin keeps holding above certain markers and buyers step in consistently, that’s bullish. But a breakdown below those levels could tell a different story.

On-Chain Analytics

Monitoring metrics like active addresses, coin age distribution, and exchange inflows/outflows gives clues about trending sentiment. Steady holding or increased off-exchange storage supports stability. Sudden selling speaks otherwise.

Market Sentiment Trackers

Tools like Fear & Greed indexes can reveal sentiment extremes. If fear rises sharply, that could mark a bottom or at least a buying opportunity. If greed returns, it may signal another wave is forming.

Expert Insight

“Cycles are normal. After a run, the market needs to cool off before new moves. Right now, we’re seeing digestion, not decline.”

It doesn’t have to be perfect—or grand. Even short pauses clear the way for bigger moves.

Keeping Perspective: Not the End, Just a Transition

It’s tempting to sound dramatic—like a run must be over the moment prices fall. But markets don’t obey our timelines. Pullbacks and pauses are natural. This one? Possibly early base-building or just a knee-jerk after months of gains.

If you’re invested—or thinking about it—watch how the market behaves around key zones. Does price hold? Do whales stop selling? Does sentiment stabilize? If yes, maybe the next leg up is brewing quietly.

Conclusion

The crypto bull run isn’t dead. It’s taking a break. Prices are lower and momentum has cooled, but there’s no definitive bottom or capitulation yet. We may well be entering that sideways consolidation that fuels the next leg. Watching key technical levels, on-chain trends, and sentiment shifts can offer early clues. Be patient—and don’t read too much finality into this pause.

FAQs

Is the crypto bull run officially over?

No—there are signs of cooling, but it’s premature to call it over. We’re likely in a correction or consolidation phase, not a full bear cycle.

What does a consolidation phase look like?

Expect sideways trading, lower volatility, and price holding within a range. It’s the market’s way of resetting before another move.

How do indicators show if a new bull run could start?

Watch momentum signals like RSI, moving averages, and on-chain metrics for signs of renewed buying or sentiment shifts.

Can macroeconomic events stop a new rally?

They can influence it. Global economic stress tends to weigh on risk assets like crypto. But it doesn’t spell permanent decline—just a variable to factor in.

Should investors wait for a confirmed bottom?

That’s a cautious approach. But waiting for full confirmation might miss early opportunity. A balanced strategy—watching key levels and behavior—can work.

What if strong selling resumes?

A breakdown below support or upticks in sell-side behavior may hint at a deeper correction. It’s a signal to reassess risk.