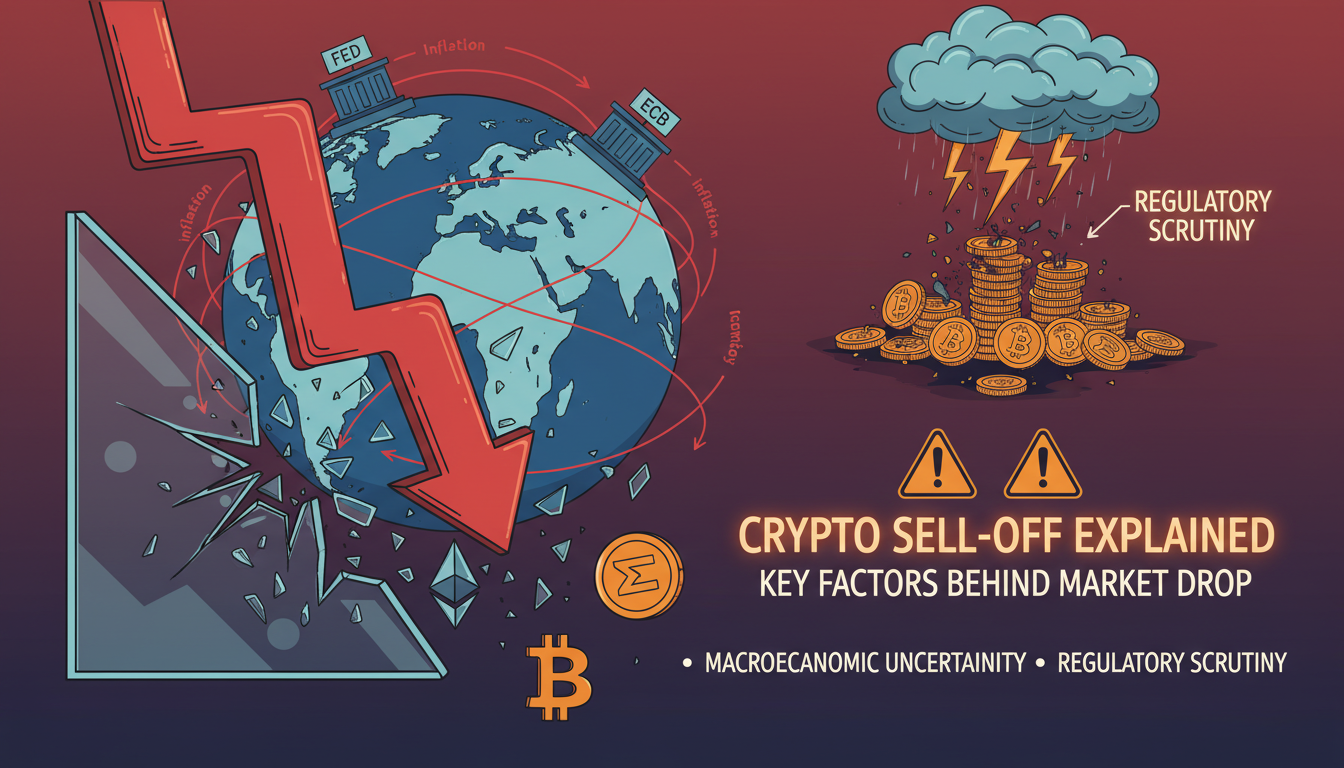

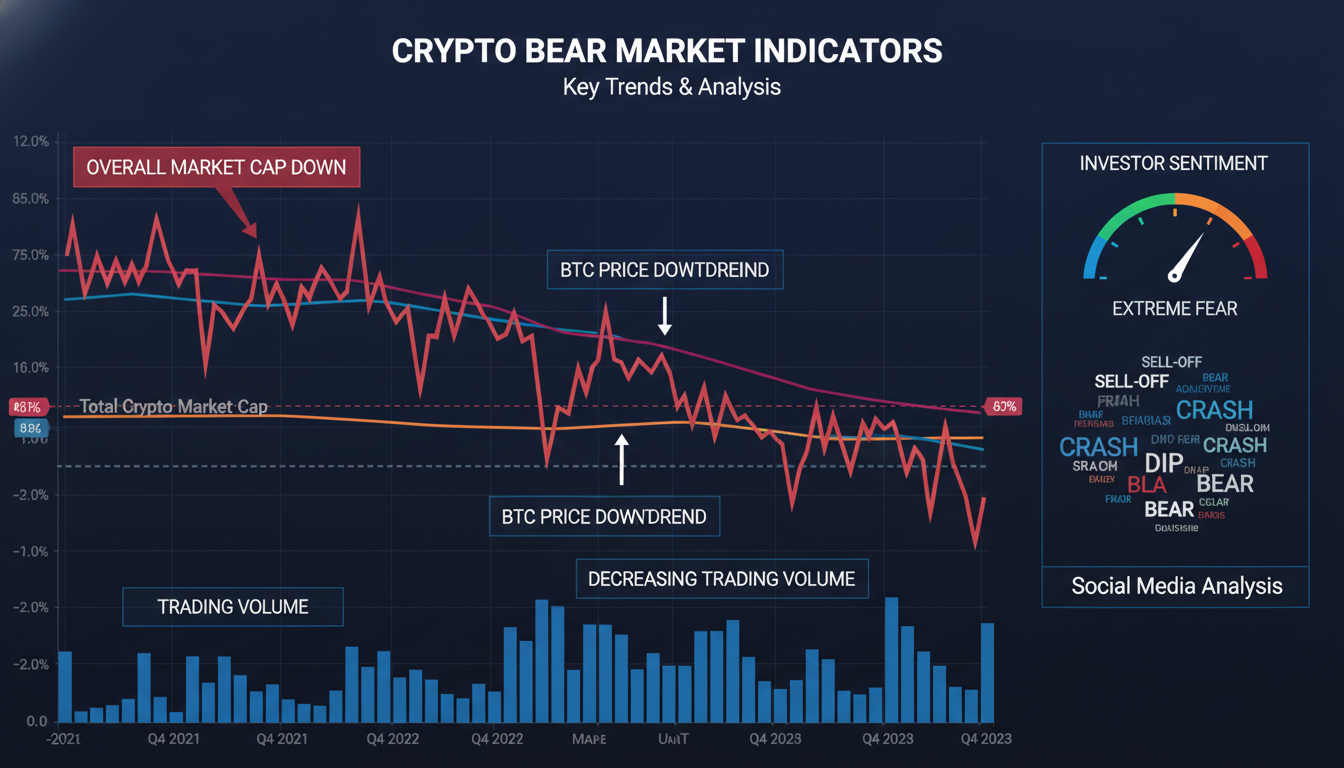

Yes—cryptocurrency markets are in a bear phase right now. Prices have dropped from previous highs, trading volumes feel sluggish, and investor sentiment is largely cautious or pessimistic. It’s not a complete crash, but the mood is undeniably bearish.

This means prices are below recent peaks, downward pressure persists, and major coins aren’t showing a sustainable rebound yet. Let’s unpack the indicators and what this means for anyone watching or holding crypto.

Spotting a Bear Market: Defining the Basics

A bear market typically implies a 20%+ drop from recent highs and persistent pessimism among traders. It’s more than just a dip—it’s a sustained trend downward, even if that trend isn’t perfectly linear.

This isn’t to say every dip is a bear market—crypto routinely sees sharp ups and downs. But when sentiment shifts, volumes dip, and technical structure looks weak—that’s when we talk bear-market vibes.

Indicators Pointing to a Bear Phase

Price Declines Across the Board

Bitcoin and Ethereum, the market’s anchor coins, are both down significantly from last year’s peaks. They’re not tanking daily, but the recovery from lows is slow and infrequent.

Smaller altcoins often follow suit—some fall even harder. That’s classic bear-market behavior: broad-based weakness, not just one or two laggards.

Lower Trading Volume & Fewer Buyers

Volumes have thinned out. Traders aren’t jumping in like they did before. Without new money fueling rallies, prices tend to stagnate or slide.

This cooling-off isn’t surprising after the wild swings of bullish runs. But the lack of follow-through when prices bounce signals real caution in the market.

Technical Patterns Say “Tired”

Charts tell a subtle story: BTC and ETH are showing lower highs and lower lows. They’re stuck in ranges or slowly trending down.

There are occasional rallies. But they tend to fail near resistance—another sign that buying conviction is weak.

Pessimistic Sentiment & News Flow

Social chatter leans bearish, with talk of regulation, macro risks, and fading enthusiasm. When conversations turn from FOMO to FUD—that signals a mood shift.

Even crypto-friendly media is more cautious—focusing on risks rather than what’s next. That narrative shift matters. It shapes how buyers and sellers behave.

Why This Matters: What You Should Watch

Opportunity in Fear—but Watch the Snake Head

Falling prices can lure long-term holders or traders seeking value. But timing matters. Catching a bounce in a sustained bear phase is tricky—false rallies abound.

Patience is key. Look for:

- Volume returning on bounces

- Breaks above clear resistance zones (not just minor upticks)

- Fundamentally positive triggers—e.g., major regulation news turning positive, institutional interest, or adoption moves

Risks Already Climbing

It’s easy to be cautious. But complacency is risky too—especially if you’re overexposed or not hedged.

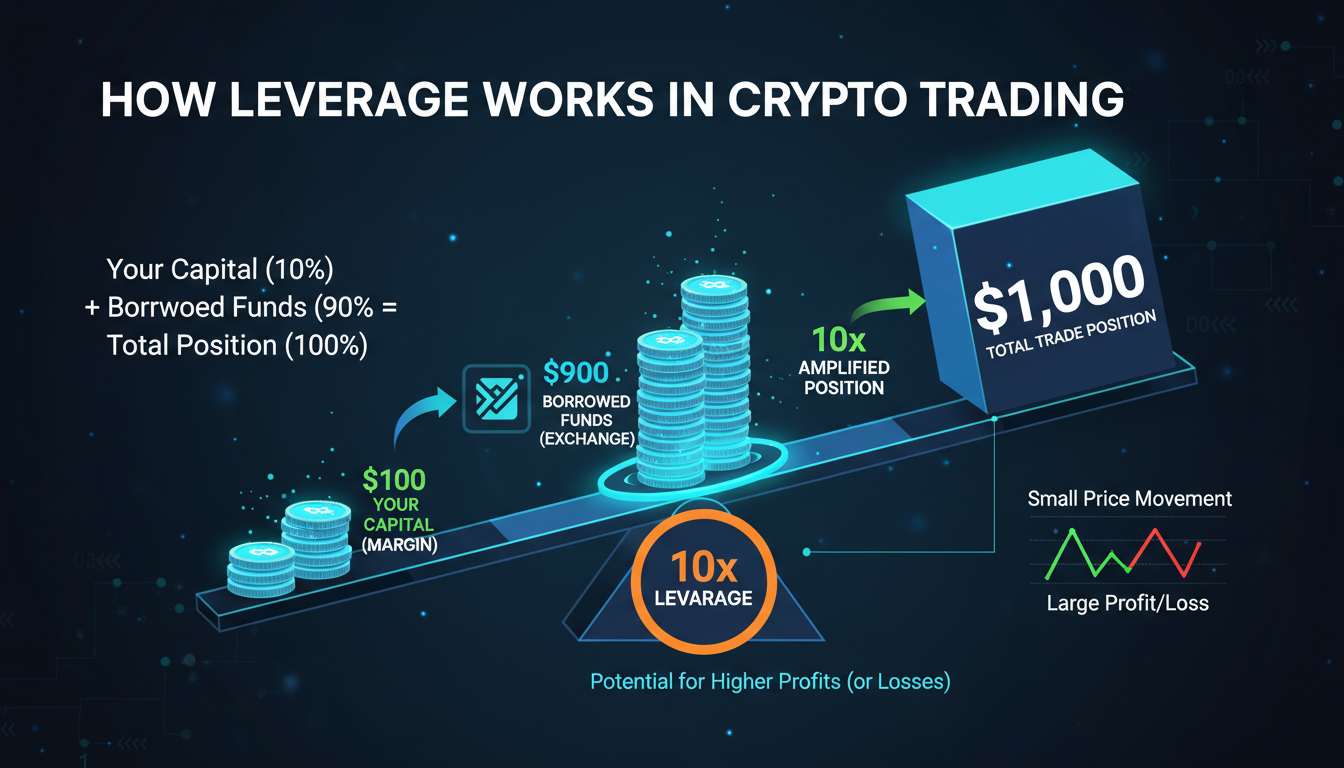

Leverage amplifies risk in a downturn. Even stablecoins can destabilize amid stress. It’s a good time to reassess holdings, lock in profits, or tighten stop-loss levels.

Real-World Example: 2018 vs. Now

Back in 2018, crypto entered a deep bear market—lasting over a year, with heavy drawdowns and cold sentiment. Rallies were frequent, but they didn’t hold.

Things look similar in structure now. But there are differences: broader adoption today, institutional money in place, and on-chain data offering more transparency.

Still, sentiment matters. Charts today echo 2018 more than 2021’s electric rallies. That’s telling.

Expert Insight

“Market cycles in crypto tend to reveal themselves in both price and human behavior—and right now, both are signaling caution.”

— Industry analyst, speaking on current trend dynamics

That nails it. Crypto markets aren’t just numbers—they’re collective psychology, too. When skepticism outpaces optimism, trends lean downward.

What To Do (and What Not To Do)

Do:

- Track sentiment and on-chain metrics

- Set clear entry/exit levels

- Stay diversified—even beyond crypto

- Consider risk-managed strategies like dollar-cost averaging

Don’t:

- Chase rallies without volume or context

- Overleverage—crypto dips can swing hard

- Ignore technical signals altogether

- Forget that sharp bounces aren’t the same as a trend reversal

Conclusion

The crypto market is in a bear phase—marked by falling prices, low volume, weak technicals, and bearish sentiment. It’s not a meltdown, but caution is the wise stance. Watch for real breakouts, volume shifts, or sentiment turning positive before declaring a bottom.

If you’re holding, reassess risk. If you’re seeking entry, adopt a measured approach. Bear markets aren’t forever—but misreading them can be costly.

FAQs

Is a 20% drop always a bear market?

It’s a general threshold, but context matters. In crypto, volatility is high, so watch if the drop is sustained and supported by sentiment and volume shifts.

Can market sentiment alone drive a bear market?

Yes, sentiment shifts often precede major price moves. Herd mentality and cautious news cycles can reinforce selling pressure even without big fundamental triggers.

Are altcoins more at risk than Bitcoin?

Usually, yes—smaller coins tend to amplify market moves. But BTC itself often sets the tone. Diversifying can help, though doesn’t eliminate risk.

When should I expect a trend to reverse?

Look for volume upticks on rallies, higher highs on charts, and positive catalysts like regulatory clarity or institutional interest.

Is this bear market similar to 2018?

Structurally, yes—longer, volatile downturns with weak rallies. Differences include more maturity today: better infrastructure, more informed participants, and on-chain data.

Should I invest during this phase?

You can, but proceed cautiously. Dollar-cost averaging, clear stop-losses, and attention to volume and trend confirmation are your allies.