If you’re looking for the best crypto under $1, here are several promising low-cap tokens offering strong potential. They combine real-world utility, emerging tech, and active markets—appealing to both strategic portfolio builders and speculative traders. Here’s the breakdown:

Quick Picks at a Glance

- HeyElsa (ELSA) – AI‑DeFi combo riding short-term hype with volume bursts

- Resolv (RESOLV) – Yield-focused DeFi token with solid tokenomics

- Basic Attention Token (BAT) – Established project with real utility in Brave browser

- Curve DAO (CRV) – Governance token for stablecoin DEX, strong fundamentals

- Sei (SEI) – Decentralized trading layer enjoying healthy volume

- Sonic (S) – Fast Layer‑1 blockchain, gains traction with DeFi builders

- IOTA (IOTA) – Feeless network targeting IoT and data economies

- Kaspa (KAS) – Ultra‑fast PoW with blockDAG tech and community support

- VeChain (VET) – Enterprise-grade, supply chain blockchain with strong partners

- Hedera (HBAR) – Hashgraph-backed, enterprise infrastructure token

- Stellar (XLM) – Cross-border payments leader with mainstream partnerships

- Fogo (FOGO), Oasis (ROSE), Owlto (OWL), Moonbeam (GLMR), EGL1 – Infrastructure plays with varying focus and risk profiles

- Momentum movers

- Seeker (SKR), Hana (HANA), Rain (RAIN), Coin98 (C98), Warden (WARD) – Showing bullish moves in Feb 2026

Why These Low‑Cap Tokens Matter

1. Utility Meets Real Technology

Many of these coins offer actual functionality. VeChain is actively used in supply chains by big brands. Hedera operates with enterprise-level speed and backing. Stellar facilitates low-cost remittances globally .

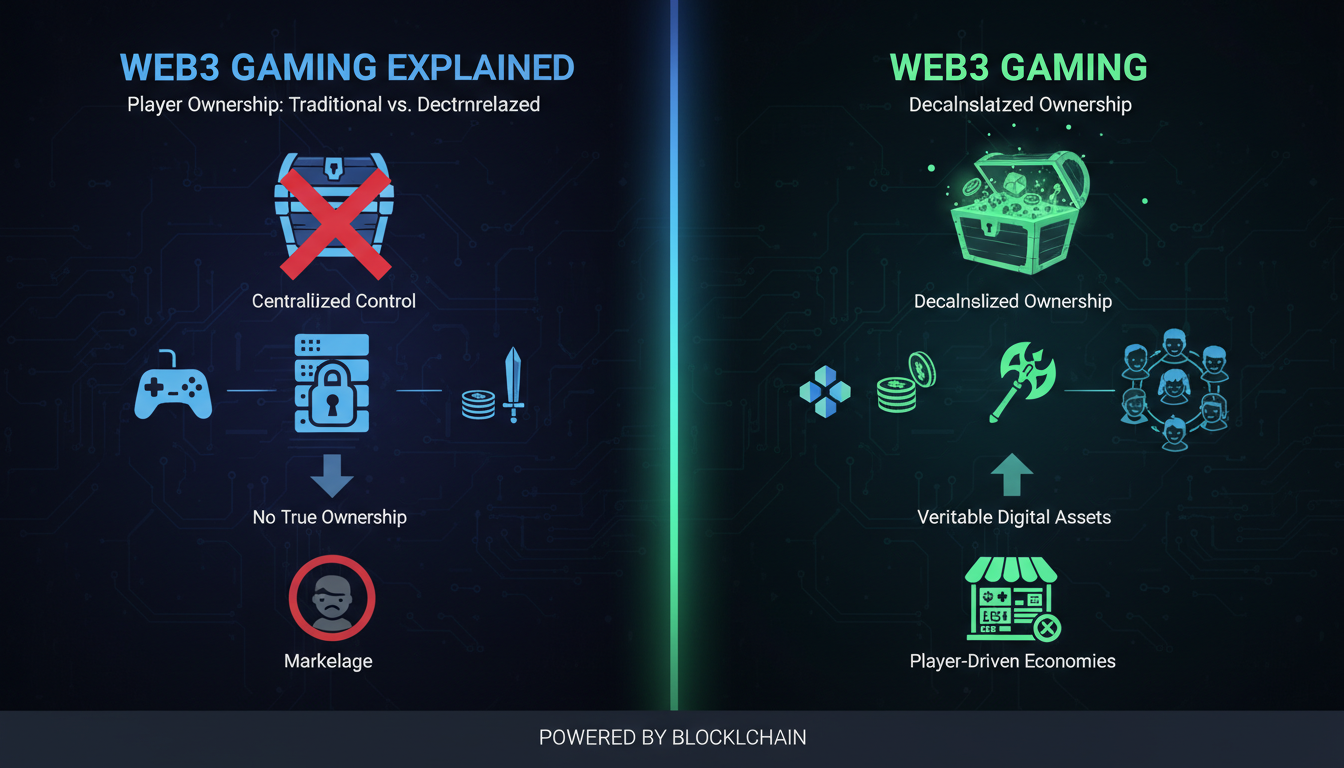

Tokens like Curve DAO drive DeFi by enabling cheaper stablecoin trading. IOTA aims at IoT and feeless data networks, while Sonic and Sei bring fast, scalable infrastructure for decentralized apps .

2. Balancing Risk with Upside

Emerging tokens like HeyElsa and Resolv ride buzz and token mechanics—but are volatile. Meanwhile, baseline tokens like BAT, Stellar, and VeChain are proven and less speculative. That blend makes them useful depending on risk preference .

3. Bright Technical Niche Plays

Kaspa’s blockDAG allows instant confirmations. Fogo, ROSE, and the others focus on DeFi, privacy, or fast throughput—appealing to builders and dev communities .

4. Bulls in Motion

If you’re hunting short-term plays, SKR, C98, and Company are showing real 24-hour volume and price action. Beat the crowd, but keep stop-losses tight .

Expert Insight

“Low‑cap cryptos under $1 offer the rare mix of accessibility and upside—especially when they deliver utility or emerging tech. But always weigh volatility against fundamentals.”

This sums up how to think about these tokens: see opportunity, know risk, and align with your strategy.

Strategic Summary

These low‑priced cryptos can enhance a diversified portfolio:

- Utility anchors: BAT, Curve DAO, Stellar, VeChain, Hedera

- Tech innovates: Sonic, Sei, Kaspa, IOTA

- Speculative movers: HeyElsa, Resolv, market momentum plays (SKR, C98, etc.)

- Infrastructure darlings: Fogo, ROSE, GLMR, OWL, EGL1

Timing and entry matter. Established tokens offer steady growth, while hype-driven ones could surge—or crash.

Conclusion

Tokens under $1 span a wide spectrum—from proven infrastructure players to buzz-heavy altcoins. You can target enterprise-grade long-term holds like VeChain and Stellar, or chase fast-moving innovation with Kaspa and Sonic. Your personal strategy—whether stable, speculative, or blended—should guide choices. Always prioritize understanding the project, not just its price tag.

FAQs

Which low‑cap crypto under $1 has the best real-world use case?

VeChain stands out with tangible supply chain integrations and enterprise partners like PwC and Walmart China, giving it solid real-world grounding .

What’s a low‑cap token with strong DeFi potential?

Curve DAO (CRV) powers stablecoin liquidity in DeFi with a governance token that tends to grow along DeFi adoption .

Looking for fast on-chain tech under $1?

Kaspa (blockDAG) and Sonic (Layer‑1 speed) provide ultra-fast, low-cost architecture suited for high-throughput use cases .

Which token could suit a cautious long-term hold?

BAT and Stellar are lower-volatility picks. BAT has browsing utility; Stellar focuses on payments with real partnerships .

Which coins are showing real momentum this month?

In Feb 2026, you’ll see strong moves from Seeker (SKR), Coin98 (C98), Hana (HANA), Rain (RAIN), and Warden (WARD) .

How do I weigh risk vs. reward here?

Stick to vision and fundamentals—not just hype. Use small allocations for high-risk tokens, and treat proven-use tokens like enterprise infrastructure as steadier holds.

This should help you navigate the lively world of low-cap cryptos under $1—whether you’re looking for stability or the potential big breakout.