Crypto pump detectors are tools traders use to identify sudden surges in cryptocurrency price and volume—often before they become obvious. They monitor metrics like sharp volume spikes, unusual order book activity, and social sentiment shifts to spot early momentum signals.

Why Detecting Crypto Pumps Matters

Catching momentum early can mean profit—or rapid loss. Rapid price jumps (“pumps”) often lure traders with promise of quick gains. But, without checks, one might step into a dump as prices reverse just as fast. A solid pump detection setup helps spot moves early, manage risk, and trade smarter—not just jump on hype.

How Pump Detection Tools Work

Volume & Price Spike Alerts

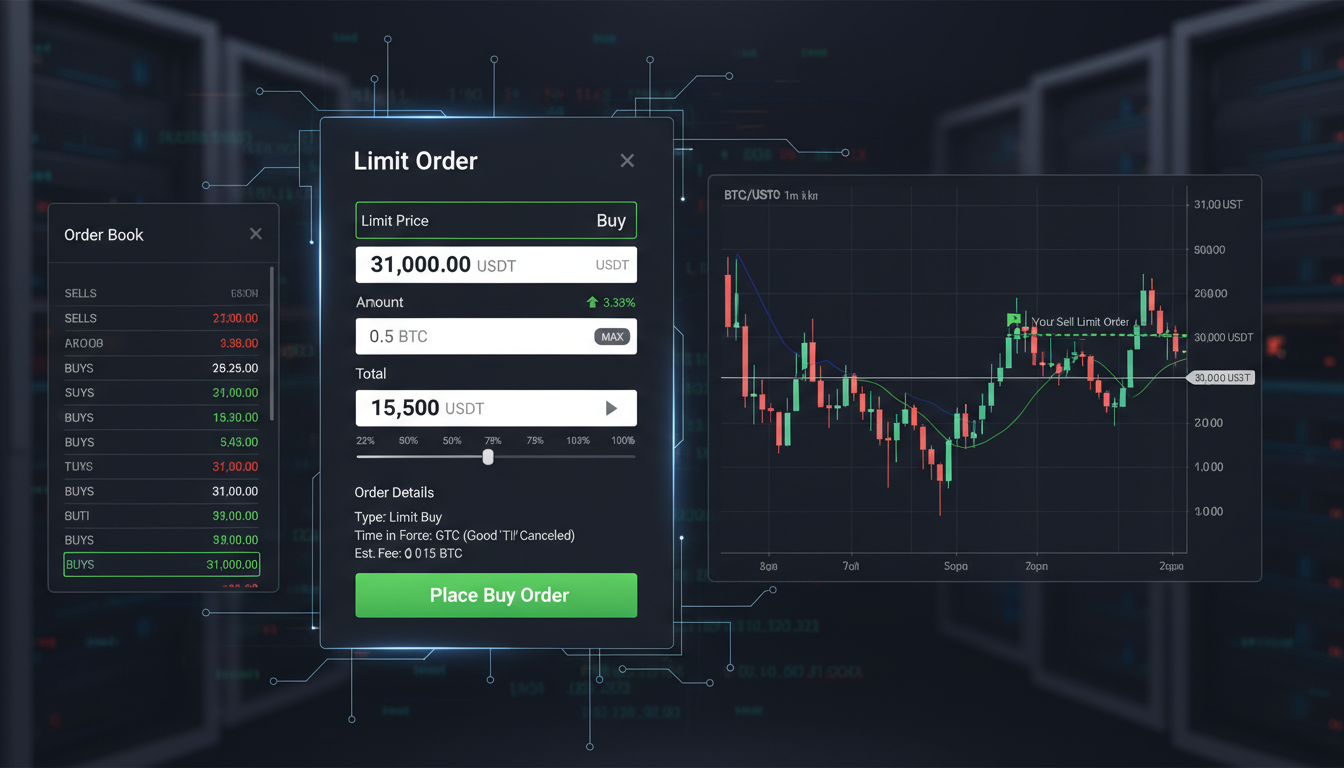

These tools scan exchanges for abrupt upticks in trading volume or price—think scaling walls of buy orders or a candle bursting upward. That early alert gives traders a front-row warning that something big is brewing.

Order Book Imbalance Monitors

Watching order books for large buy or sell walls gives clues about potential shifts. If a massive bid shows up, it might signal a breakout in the making. On the other hand, an overwhelming sell wall might point to a retracement.

Social Media & Sentiment Tracking

Sudden mentions spiking on platforms like Twitter or Telegram often precede real-world gains. Some tools tie into NLP engines to rate comments as bullish, bearish, or neutral. A big uptick in bullish chatter? One more signal tightening the early-warning net.

Cross-Exchange Alerts

Sometimes pumps begin on one exchange before rippling across others. Tools can flag discrepancies—say, an asset running hot on Exchange A but calm on B. That divergence can signal an internal trigger, helping spot the move before it’s everywhere.

Real-World Example: The Dogecoin Spike

Last year, Dogecoin’s unexpected jump spooked traders. One dashboard flagged a sudden 300% volume surge in under 10 minutes. It also noted a big imbalance in bids and flood of “to the moon” chatter. That trio of signals helped alert smart money before the price tripled—and then tumbled just as fast.

“Seeing how social hype, trading volumes, and order books align is like watching a volcano rumble before eruption—it gives a chance to act, if you’re fast.”

— A seasoned crypto analyst, speaking from experience

Building Your Own Pump Detection System

Tools & Data Sources

- Exchange APIs: Collect real-time price, volume, and order book data.

- Social APIs: Feed from Twitter, Reddit or Telegram.

- Alert platforms: Services like TradingView or custom scripts to notify on signal thresholds.

Strategy Framework

- Define thresholds: What counts as a sharp enough spike?

- Multi-factor confirmation: E.g., volume + order book + social buzz.

- Rate signals: High-confidence alerts needed before acting.

- Always manage risk: Even strong signals aren’t guarantees. Set stop-loss or position limits.

Pros & Cons

| Pros | Cons |

|——|——|

| Early entry potential | Susceptible to false alarms |

| Data-backed alerts | Requires robust infrastructure |

| Avoids emotional trading | Social chatter can be manipulated |

Practical Tip

Start with paper trading. Test your alerts in demo mode. Watch how signals fared before risking capital. Over time, refine thresholds, tweak filters, and build a pattern library of what tends to lead to real momentum vs noise.

Summary

Crypto pump detectors spot sudden moves by tracking volume, order flow, and sentiment. Those early alerts can be powerful—but not perfect. By combining multiple data feeds, thoughtful thresholds, and cautious risk rules, traders can set up a system that gives a head start in volatile markets.

FAQs

What’s the fastest signal of a crypto pump?

Volume spikes often show up first, closely followed by order book shifts or social media surges.

Are social media signals reliable?

They can be useful, especially when paired with data from volume and order books—but they’re also prone to hype and coordination noise.

Can I use just one data source?

It’s risky. Relying on a single indicator raises false alert rates. Combining factors improves signal quality.

Are pump detectors only for short-term traders?

Mostly, yes. Momentum alerts are especially useful for scalpers or swing traders. Long-term investors might pay less attention.

Do detection tools automatically trade for you?

Some systems plug into bots, but automation adds risk. Even experts recommend cautious, manual review before executing trades.