Warren Buffett firmly stands by his long-held stance: he doesn’t invest in cryptocurrencies because they don’t produce tangible value like businesses do. He sees them as speculative assets without intrinsic earnings potential, preferring investments in companies that deliver clear, long-term cash flow.

Buffett’s Core Investment Philosophy

Growing up watching Buffett’s annual letters and talks, it’s clear he’s all about value—real earnings, strong moats, understandable business models. That means predictable revenue, durable competitive advantage, solid management and a price that makes sense against future profits.

Crypto? It doesn’t fit. No dividends, no history of steady results, and, honestly, he often says it’s not even an asset he can wrap his head around. He wants businesses, not tokens or hype that might fade by tomorrow.

Yet, there’s nuance: Bitcoin especially can serve as a digital safe haven for some people. Buffett may not personally touch it, but plenty of those investing in wealth protection view it that way, though he’d argue they’re better off with something earning real returns.

Why Buffett Steers Clear of Crypto

No Intrinsic Value or Cash Flow

The biggest reason: cryptocurrencies like Bitcoin or Ethereum generate no earnings—no rent, no dividends, no interest. Buffett is adamant that value comes from actual, measurable cash flow. You invest in a business for profits; you don’t invest in an asset simply because someone else might pay more later.

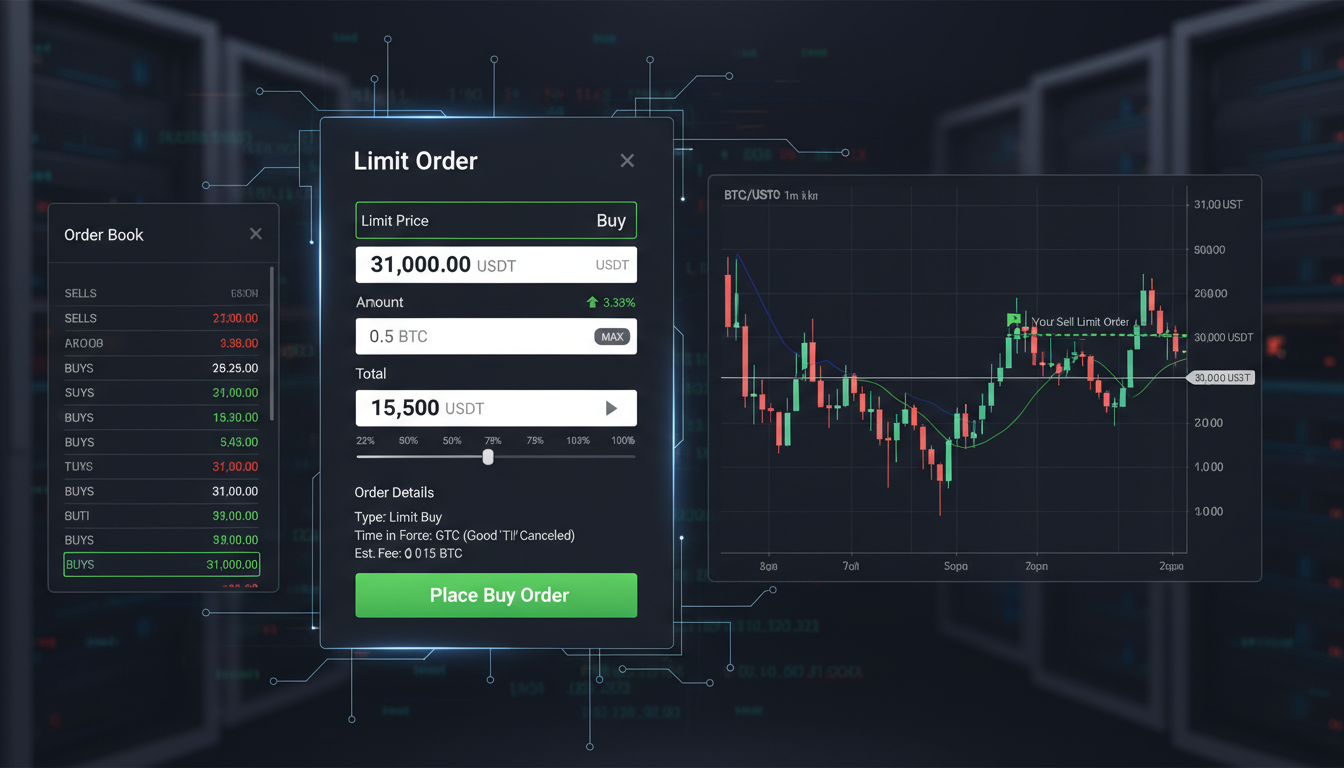

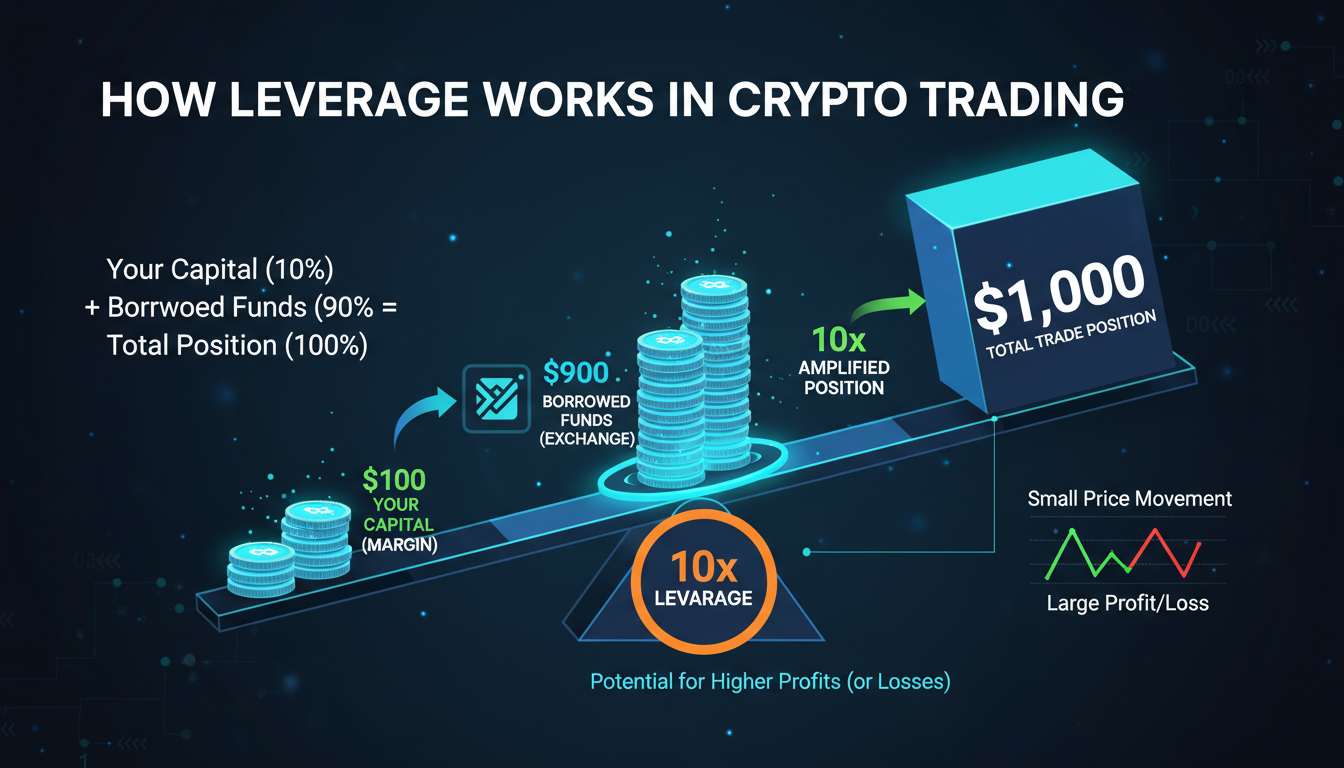

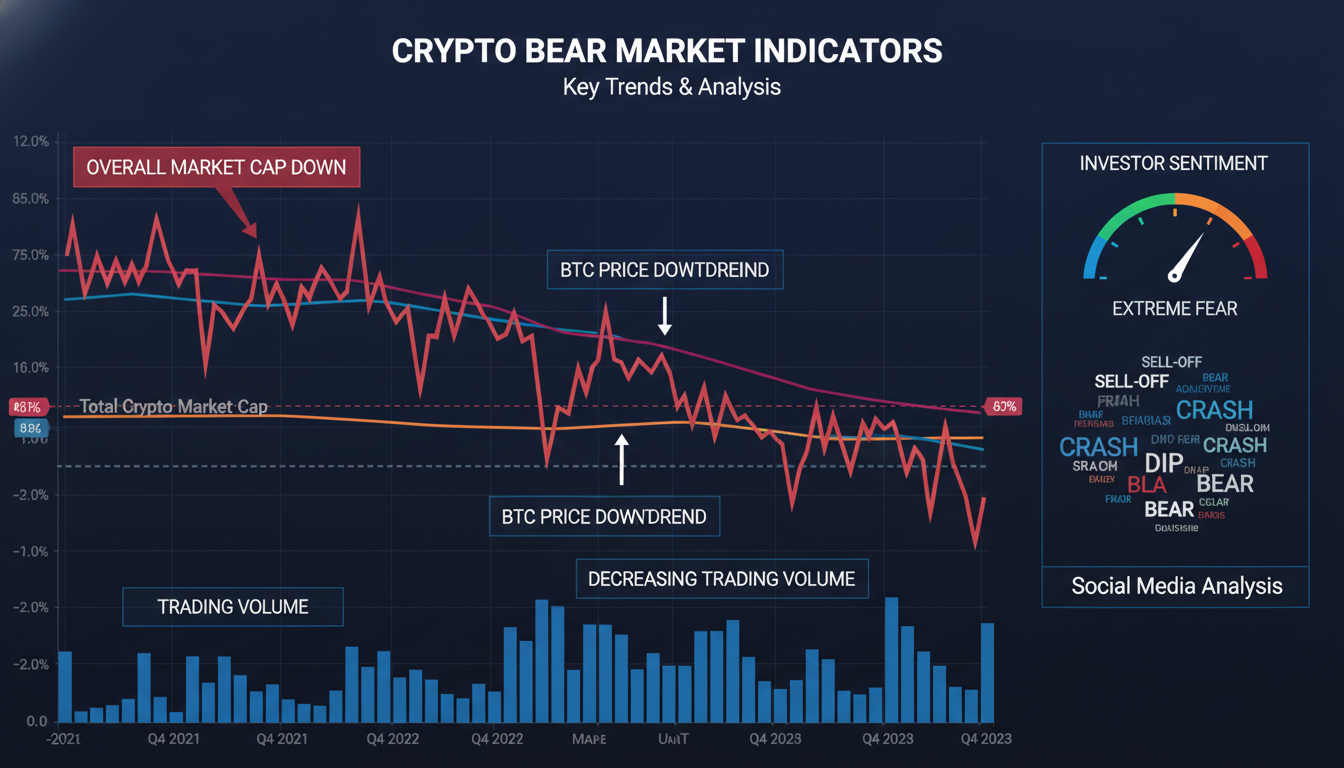

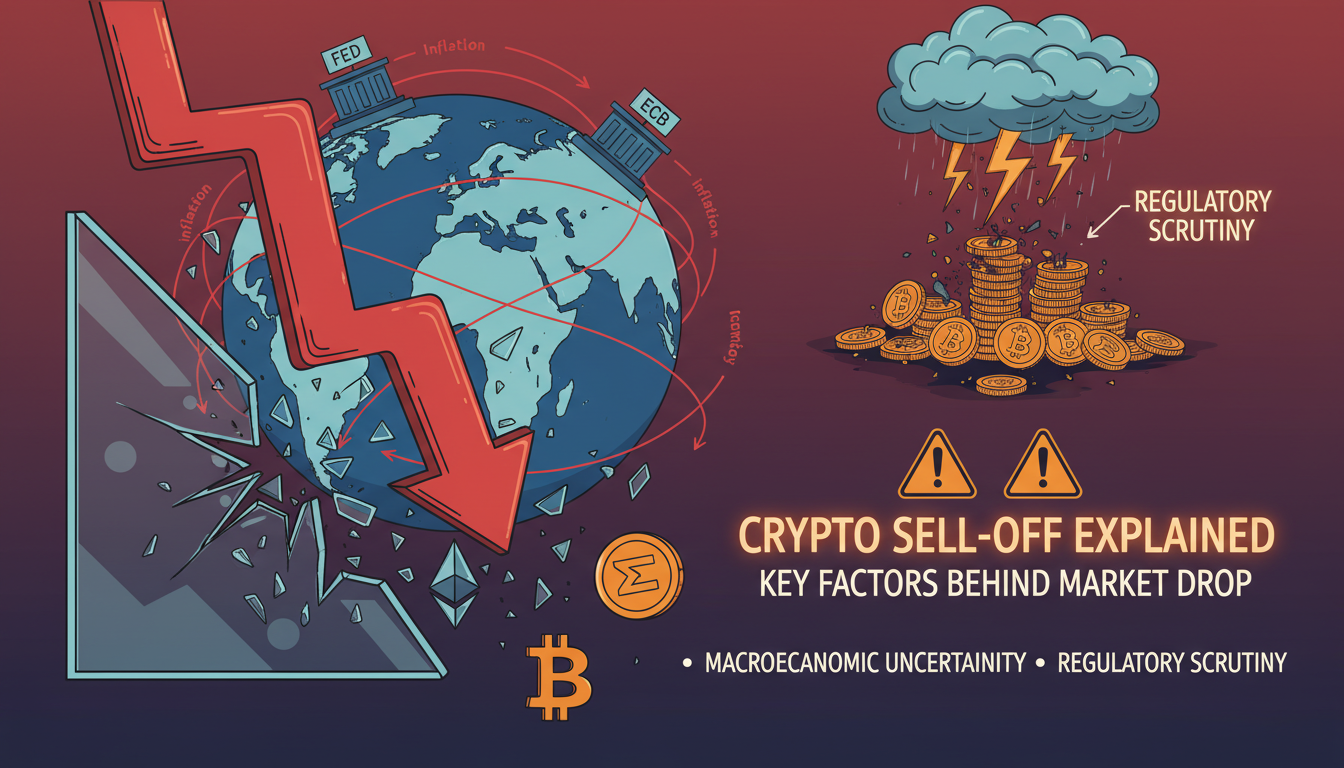

Too Speculative and Volatile

Crypto markets are notorious for wild swings. You can gain big—or lose even more. For someone like Buffett, volatility isn’t inherently bad—but when it comes without fundamentals to calm it, that’s irresponsible. Traditional businesses offer stability; crypto doesn’t.

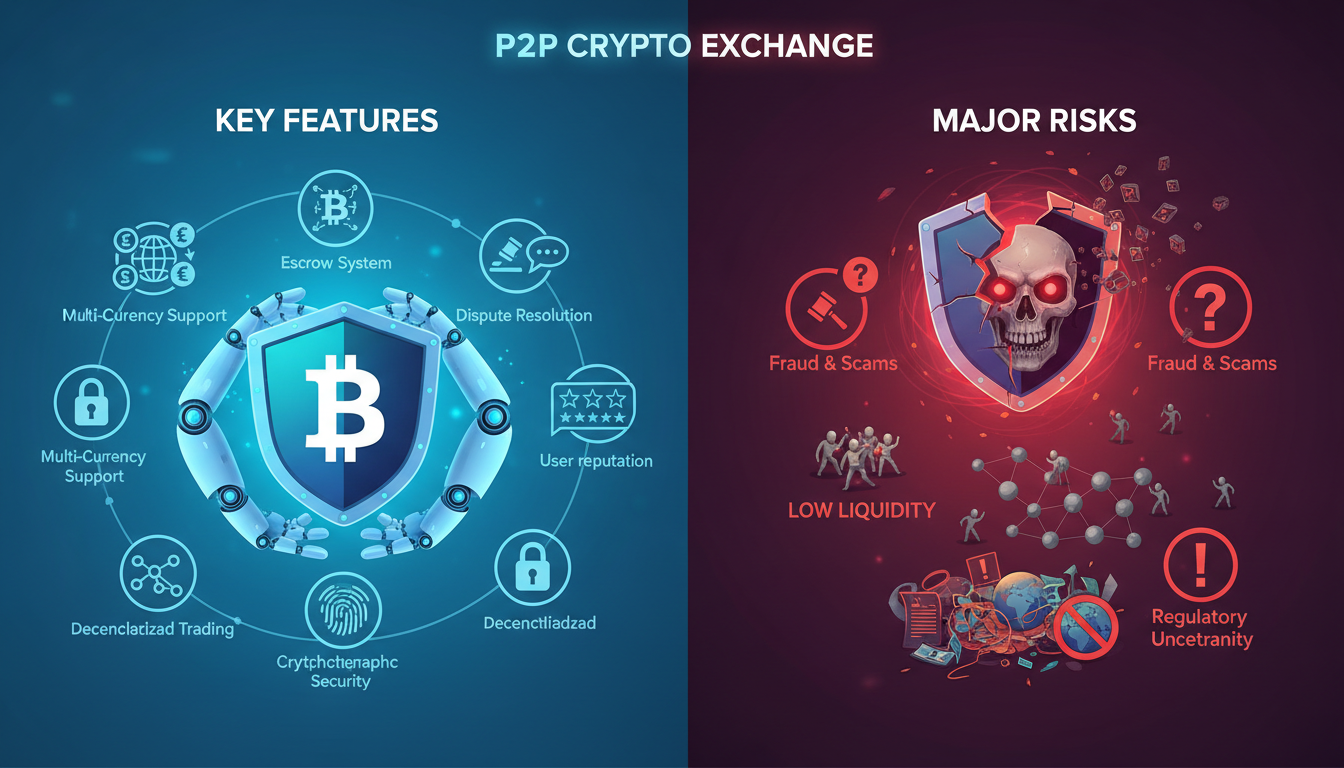

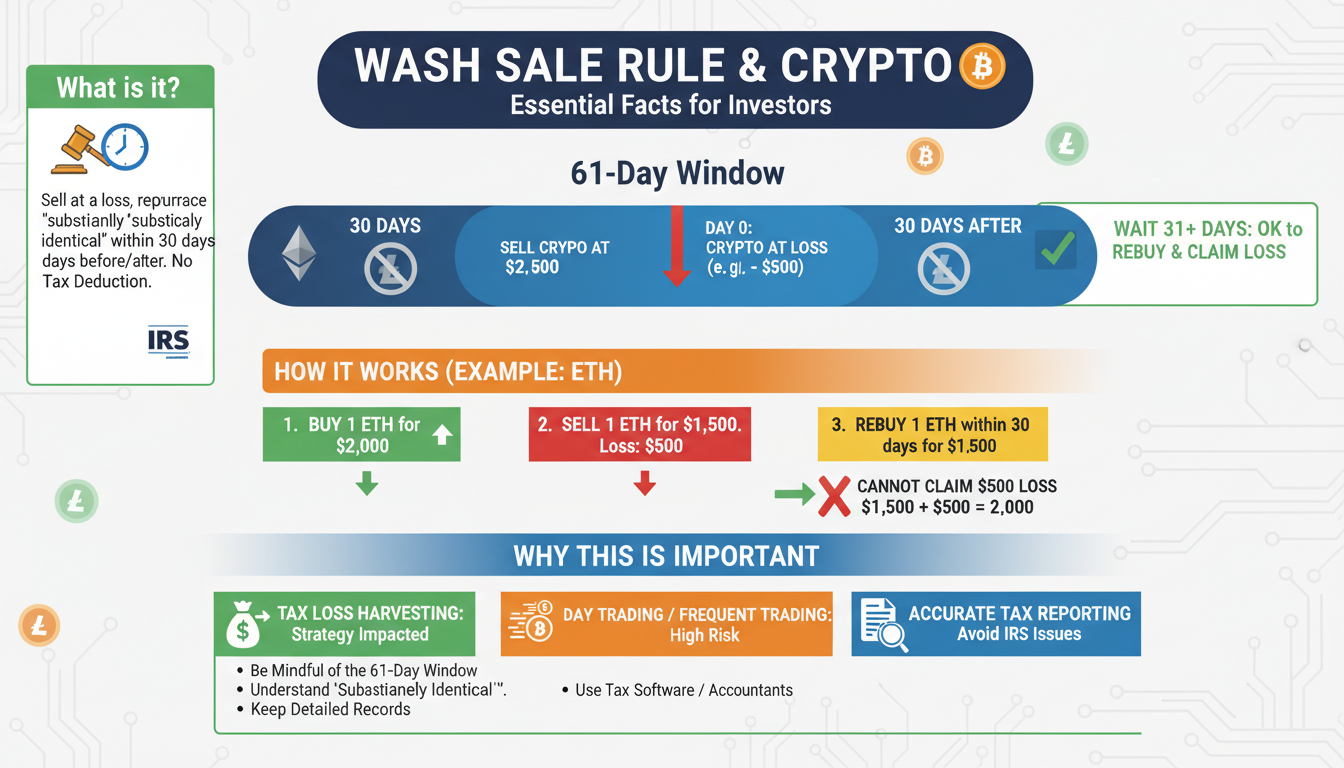

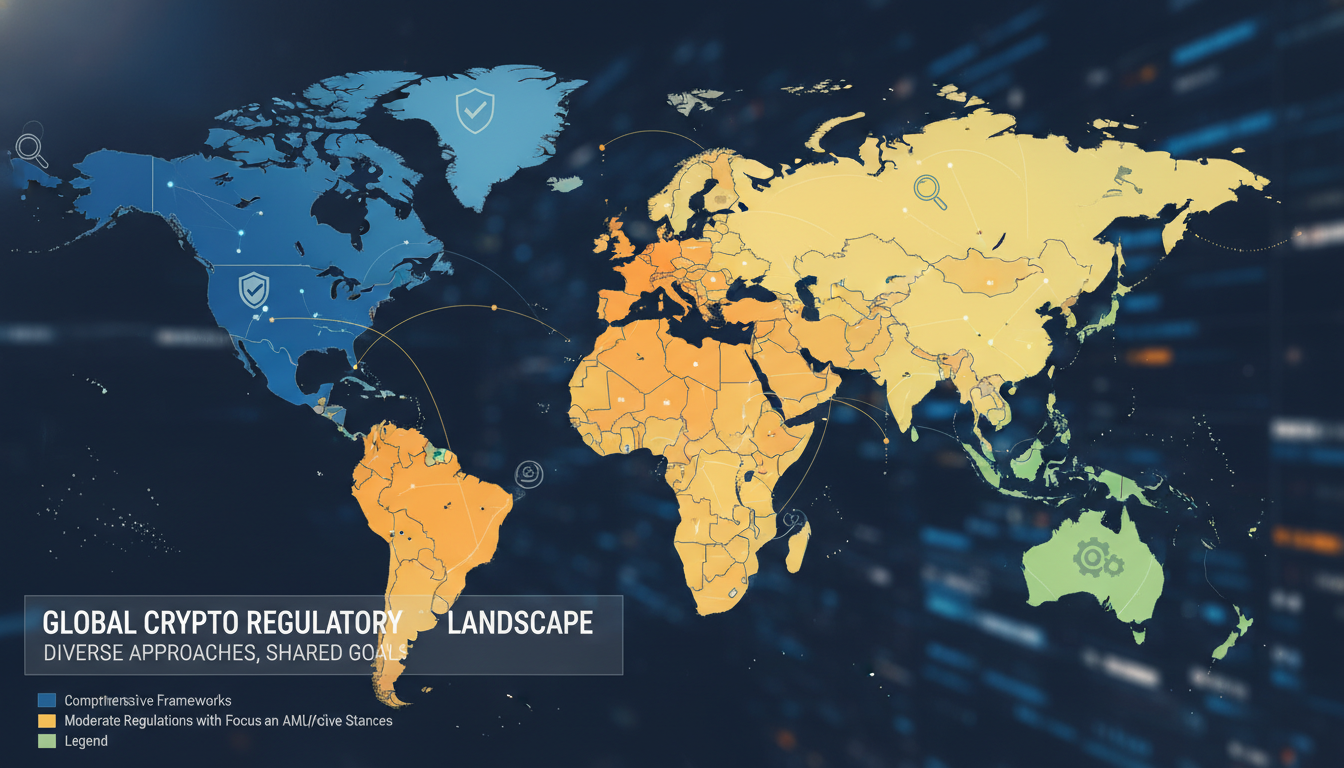

Regulatory and Technological Uncertainties

He’s also wary of the legal gray area around crypto and how quickly technology can shift. Regulations can change, and newer technologies or coins can dethrone existing ones—or vanish altogether. That’s not an environment he likes.

Occasional Caveats and Historical Comments

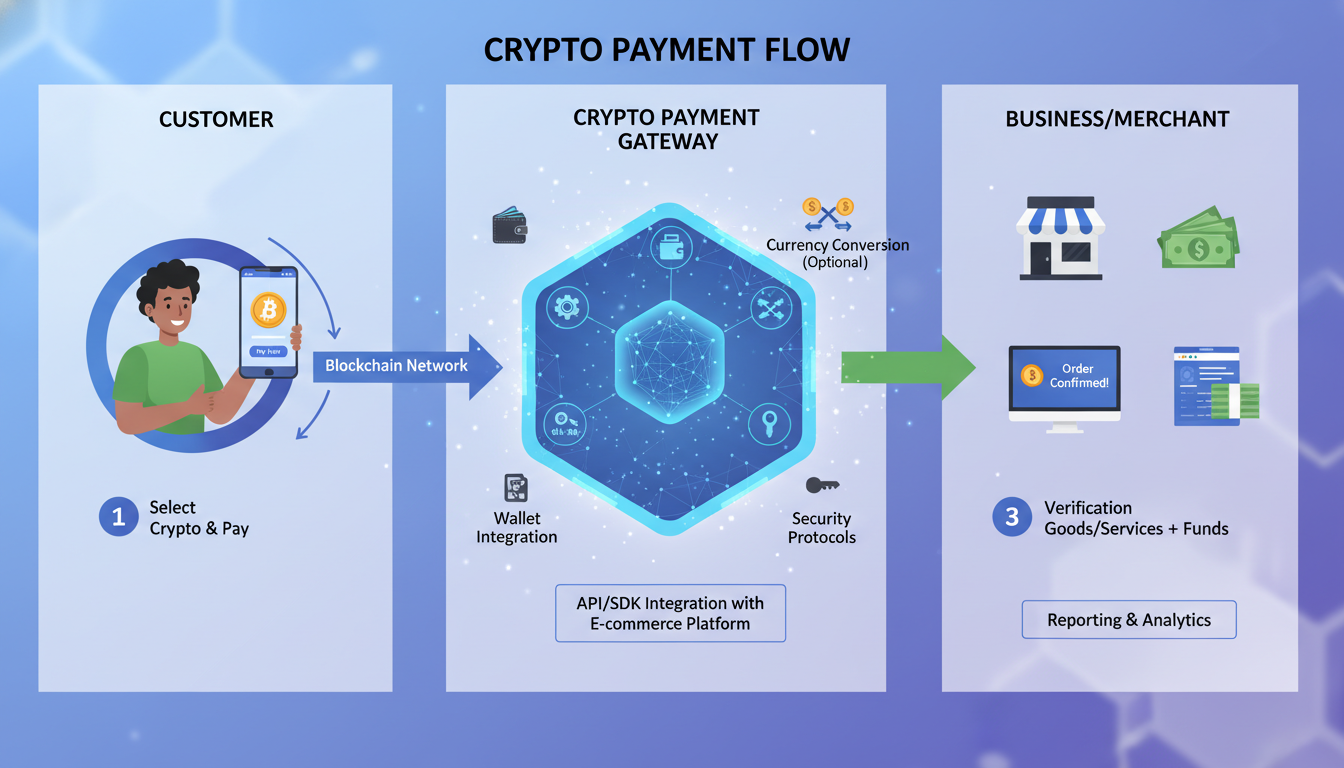

Buffett occasionally notes that while he’s unlikely to invest in cryptocurrency, he respects what blockchain technology could do in areas like payments or supply chain tracking. That’s different—a tech infrastructure versus speculative coins.

Also, he’s said he wouldn’t bet against long-shot successes in crypto. Meaning, if someone really believes in it and can afford to lose it, go ahead. He just doesn’t see it as part of a value investor’s toolkit.

Emotional vs. Rational Investing

He often brings us back to this core message: invest with reason and a margin of safety. Emotion-based speculation—fear of missing out, hype, herd mentality—doesn’t suit the rational model he built. And crypto markets are loaded with emotion.

Real-World Context: What This Means for Investors

Not everyone’s portfolio is a beige Buffett mirror. Still, here’s what his views suggest to us:

- Focus on fundamentals. If you’re building a long-term strategy, prioritize assets that generate income or growth.

- Use discretion with crypto. If you invest, consider it a small, speculative slice—not core allocation.

- Separate speculation from strategy. Be honest: is it gambling or investment? Know the difference.

- Stay agile but grounded. Follow innovation like blockchain, without sacrificing rational analysis.

“Wisdom from the Oracle”

“Price is what you pay. Value is what you get.”

That nugget holds whether you’re buying stocks or debating crypto. If there’s no value behind the token, the price is just a guess.

The Verdict

Buffett wouldn’t touch crypto purely for speculation, but he hasn’t ruled out its usefulness in tech. He’d say to stay focused on what you can analyze, understand and measure in terms of real value.

FAQs

How does Buffett define value in investing?

He looks for businesses with predictable profits, strong competitive moats, competent leadership, and a sensible purchase price relative to intrinsic worth.

Has Buffett ever invested in blockchain or crypto-related stocks?

He hasn’t invested in direct crypto assets, but he and his partners have invested in payment companies—though none tied directly to crypto.

Why does Buffett warn against emotional investing?

Because decisions driven by fear or hype often disregard fundamentals. That’s the opposite of his disciplined, value-first approach.

Could Buffett change his view?

Hypothetically, if crypto earns reliable income or widespread utility, his stance could shift. But as things stand, it remains speculative at best.

What’s a practical takeaway for retail investors?

Keep crypto exposure small and speculative. Anchor your money in assets with real, measurable value—like solid businesses or diversified funds.