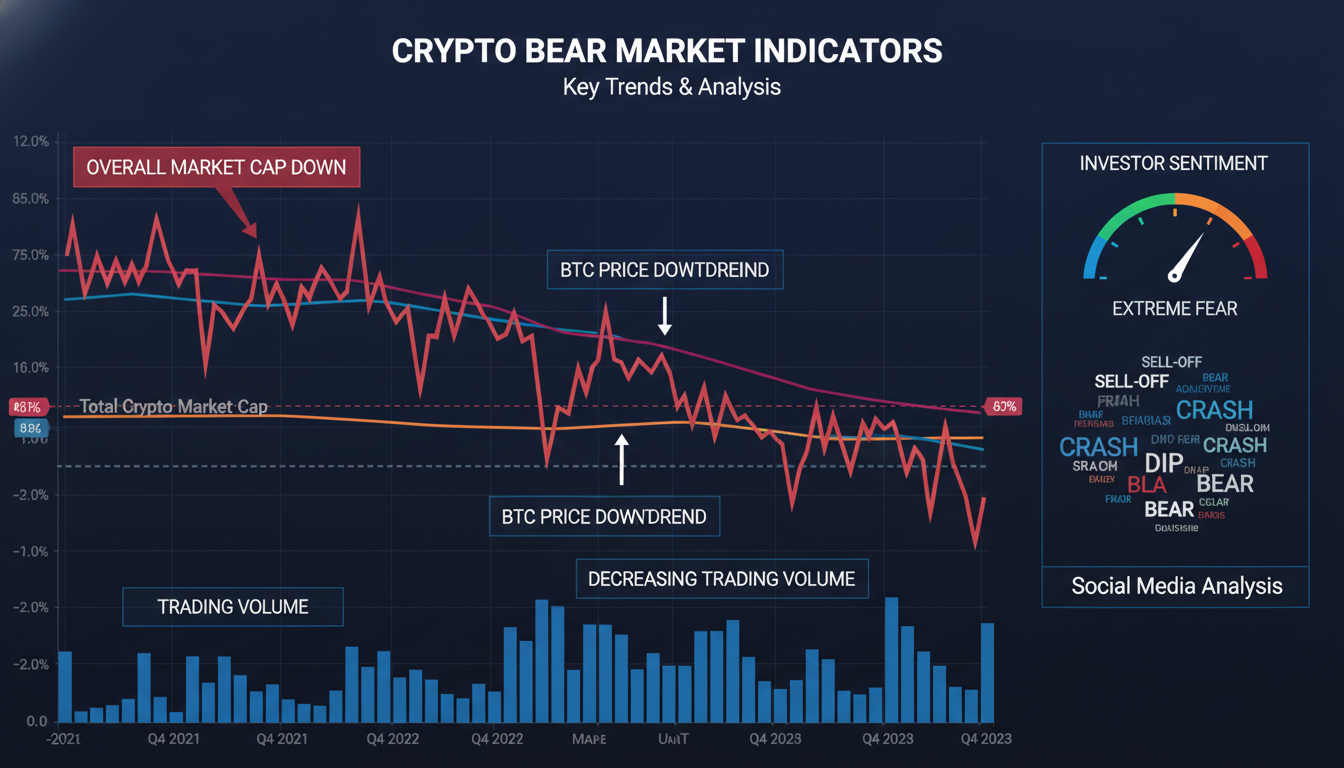

The next crypto bull run is expected to unfold in stages, with many analysts pointing to macroeconomic improvements, upcoming regulation clarity, and renewed institutional interest as key drivers. They anticipate that easing inflation, growing acceptance of digital assets, and fresh capital inflows could set the stage for a strong upward move in crypto markets, potentially beginning in the next few months and extending into 2026.

Why a Bull Run May Be Around the Corner

Sentiment is shifting. Central banks seem to be slowing rate hikes, and inflation appears to be cooling. That’s creating a friendlier backdrop for risk assets like cryptocurrencies. Also, governments are inching toward clearer regulation. That gives investors more confidence. On top of that, institutional players who have been on the sidelines are starting to step back in.

In short: more clarity, more money, and calmer markets. That’s the recipe analysts often cite for the next crypto rally.

Key Factors Analysts Watch

Macro Trends and Monetary Policy

Interest rates and inflation are big, obvious beasts. If central banks pause or reverse rate hikes, it cools pressure on financial markets. Analysts see that as a green light for speculative markets. Inflation retreating means people feel safer to move into growth assets. In some cases, crypto even gets talked about as a hedge.

Beyond this, global economic data, from employment to manufacturing, plays a part. Positive surprises lend a hand to bullish momentum.

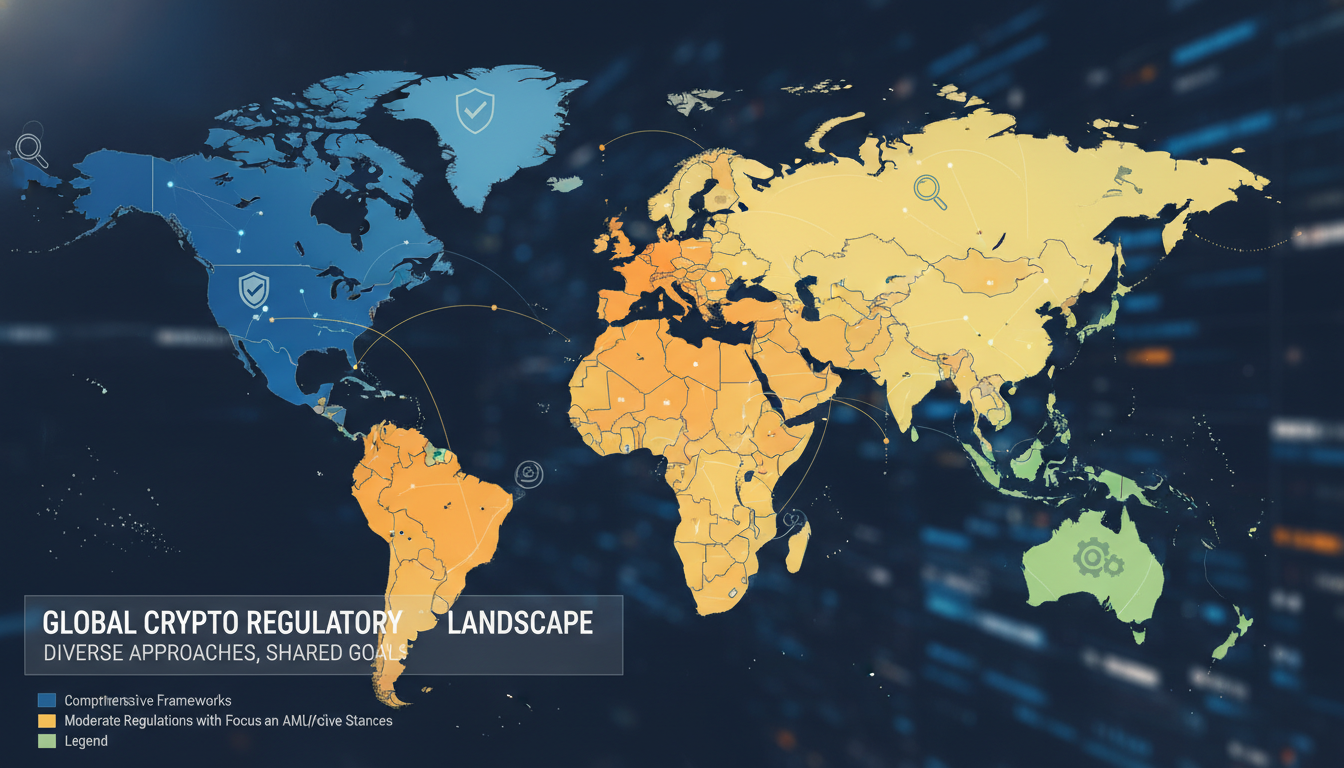

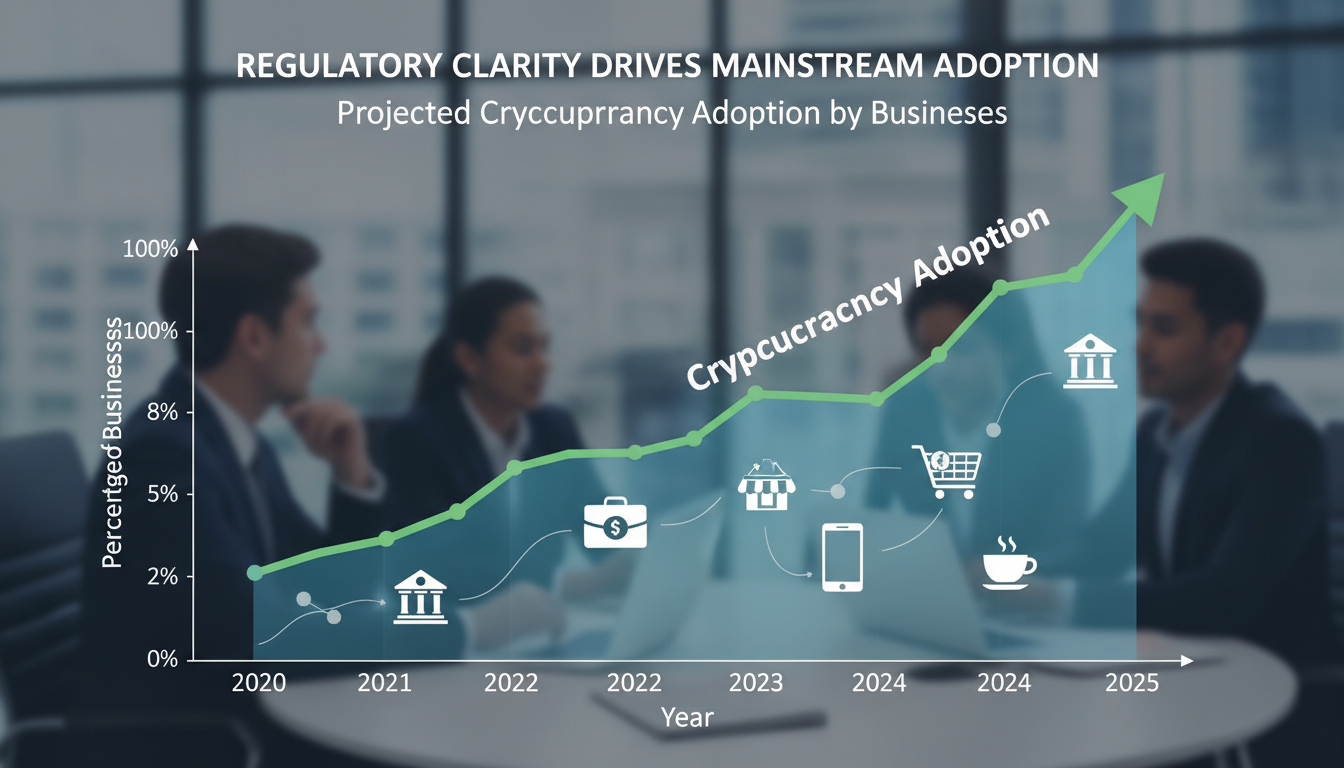

Regulatory Clarity and Institutional Buy-In

Regulation has loomed large for years. Now, it’s coming into focus. Clearer rules in the US, the EU, and Asia are easing compliance worries for big players. That’s encouraging institutional investment.

It’s not just banks anymore. We’re seeing corporate treasuries and asset managers explore tokenized assets or venture into digital currencies. That builds a foundation for broad, lasting demand.

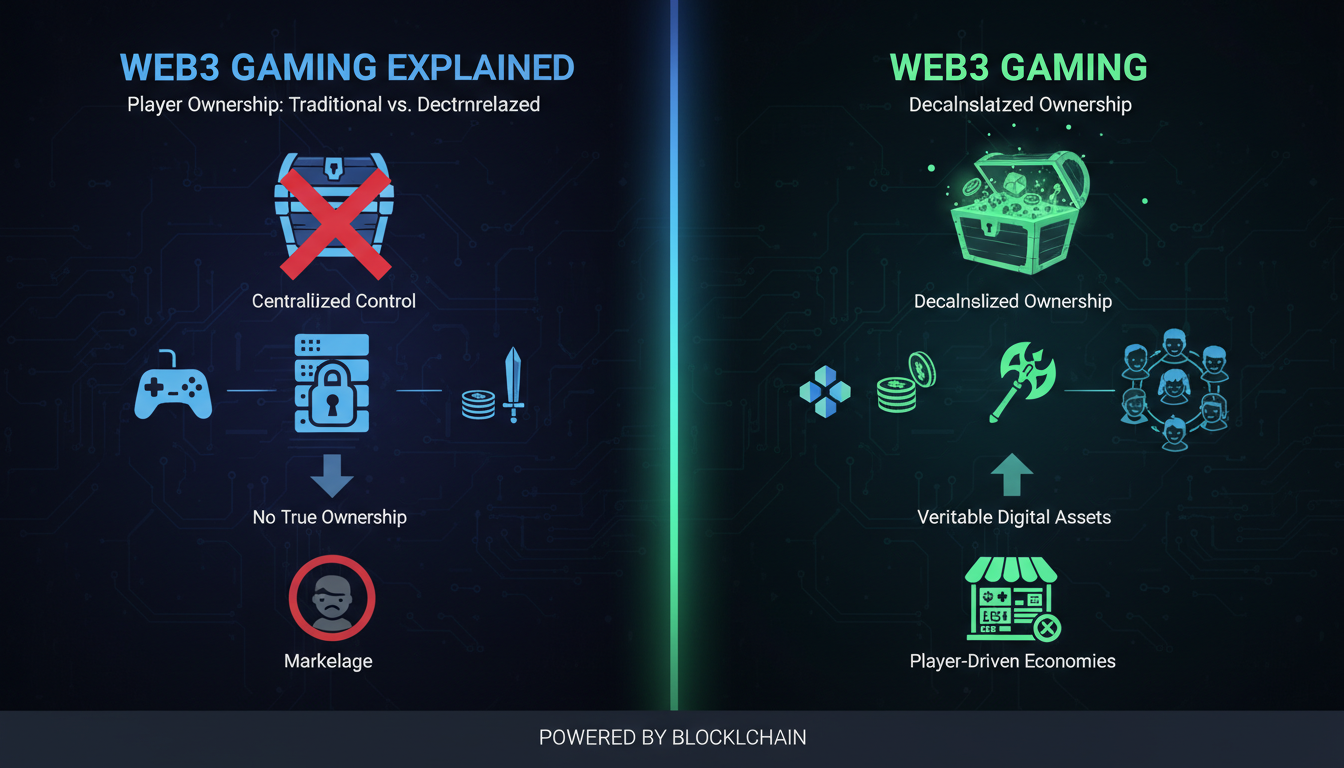

Technological Advancements and Network Developments

Ethereum’s shift to proof-of-stake, new DeFi protocols, and layer-2 scaling solutions are changing the game. That tech improvement not only enhances utility but also brings new users in. Some say we’re watching Web3 adoption grow, piece by piece, adding fundamental strength to the space.

These innovations don’t guarantee a bull run—but they add credibility and use cases, which can attract and retain capital.

Timelines: When Might the Bull Run Start?

Short-Term (Next Few Months)

Markets often jump ahead of fundamentals. Analysts expect initial surges to begin once rates stabilize and some key regulation gets approved—perhaps within the next quarter or two. Remember, crypto often leads risk-on sentiment, so even slight positive macro shifts could spark moves.

Mid-Term

Many forecast a fuller, more sustained rally by late 2025 or into early 2026—especially if Bitcoin surpasses a new high. That tends to pull the broader market with it. If institutional flows grow steadily, this could evolve into a more mature bull phase.

Long-Term

Looking further ahead, structural themes play their part. Broader adoption, digital asset integration into financial systems, and global regulations could help sustain momentum. Still, volatility remains, and no one’s predicting a smooth ride.

Different Analyst Views

Cautious Optimists

These analysts expect a steady pick-up, often tied to macro signals and regulatory milestones. They warn: even with favorable conditions, the rally could stall or correct sharply. Their view: run fast, but watch your stops.

Bullish Scenarios

Some are more optimistic. They predict that if Bitcoin breaks key resistance, momentum could snowball quickly—think double-digit gains over a few months. They point to network effects and FOMO (fear of missing out) kicking in.

“If institutional buyers really step in en masse, we could see a feedback loop of rising prices and growing investor interest that fuels the next major surge,” says a veteran crypto strategist.

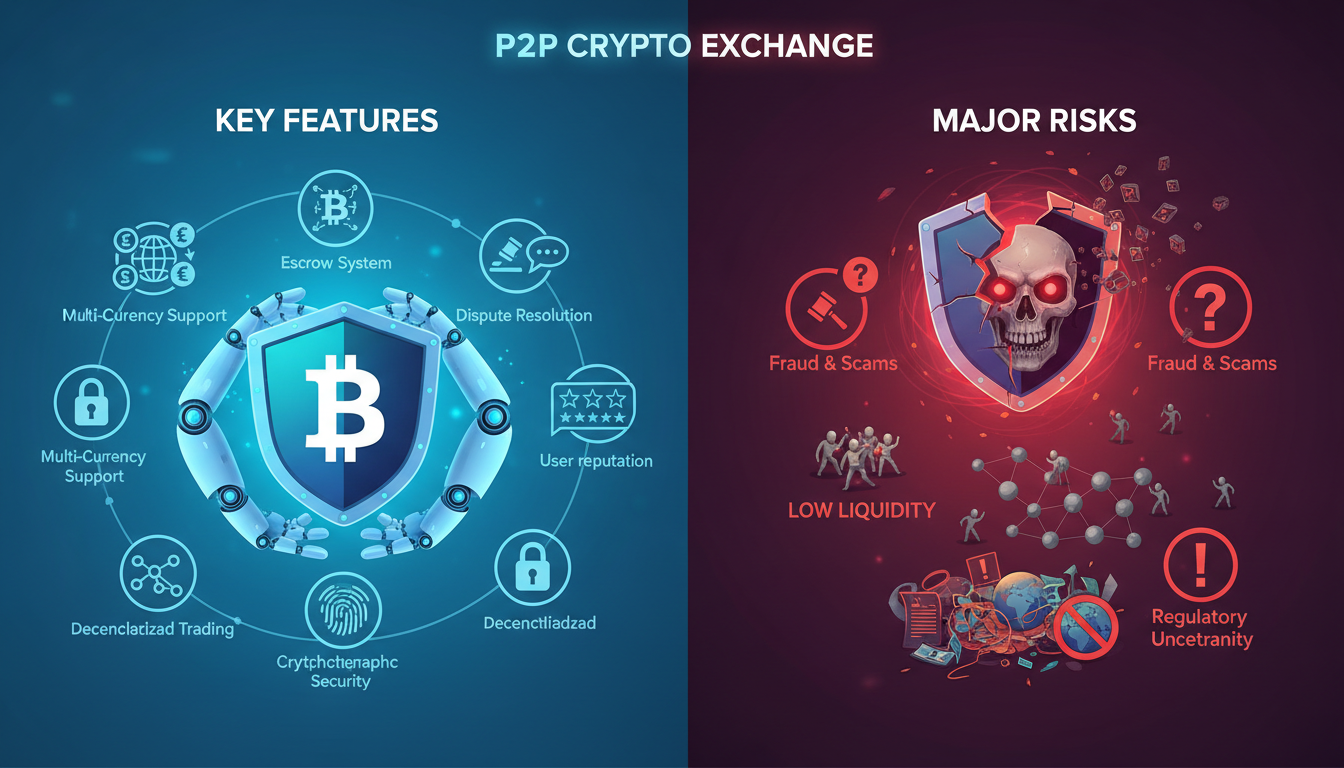

Risk-First Perspectives

Then there’s the more cautious camp. They highlight systemic risks—market manipulation, geopolitical shocks, or black swan tech failures. They say even if a bull run starts, it might be short-lived or shallow.

Real-World Examples and Context

- Late 2020 saw a bull run that began quietly, fueled by macro stimulus and institutional interest. Few thought Bitcoin would hit its next peak so fast. It happened.

- Early 2021 marked a frenzy fueled by retail activity and meme coins. That illustrates how hype cycles can accelerate moves—but also lead rapidly into sharp corrections.

Those snapshots show how sentiment and capital flows can shift quickly. They suggest that while fundamentals matter, psychology sometimes drives the timing.

Practical Tips for Watching the Bull Run

Watch Macro Indicators Closely

Follow CPI releases, Fed announcements, job reports. If markets cheer them, crypto may follow.

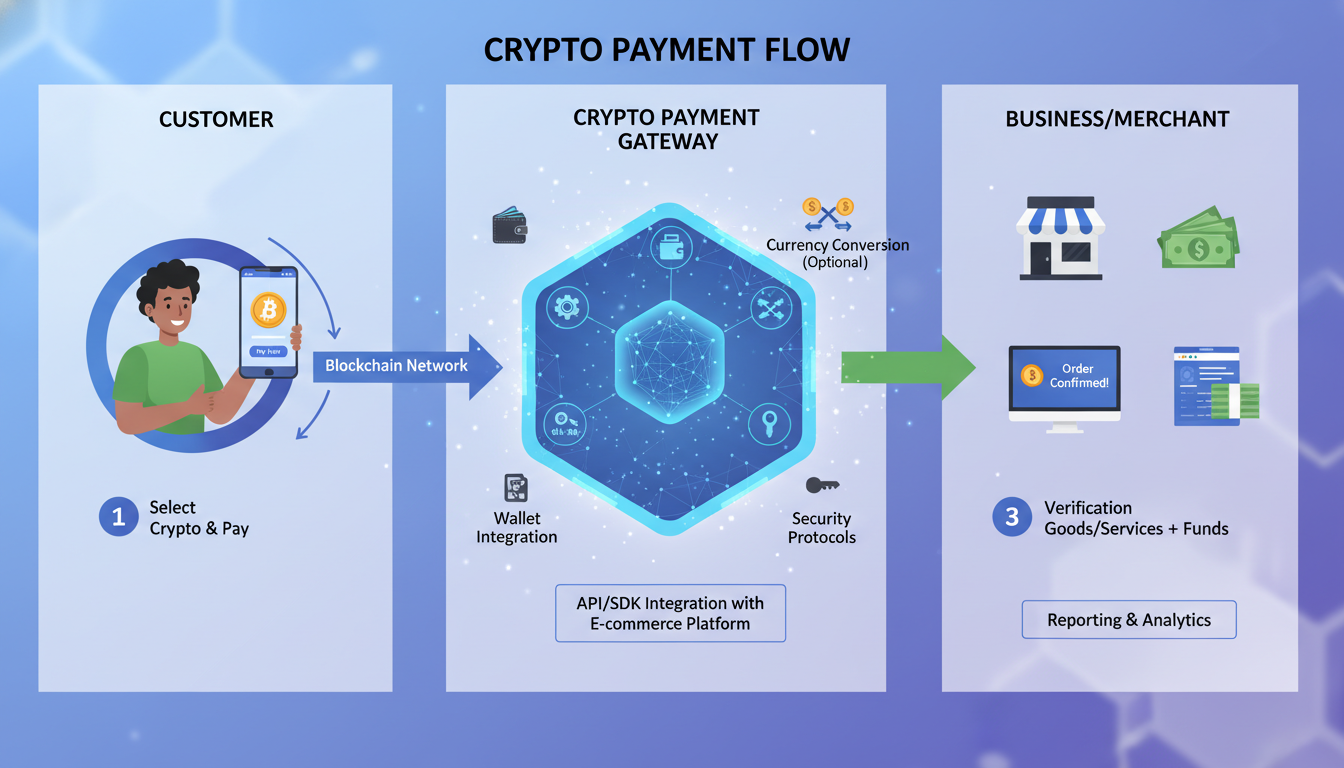

Track Policy Progress

Be alert to clues from regulators on ETF approvals, stablecoin rules, or digital asset supervision. Those nudges often trigger move.

Monitor Institutional Signals

If big names announce crypto exposure or launches, take notice. It often signals serious pivot points for price action.

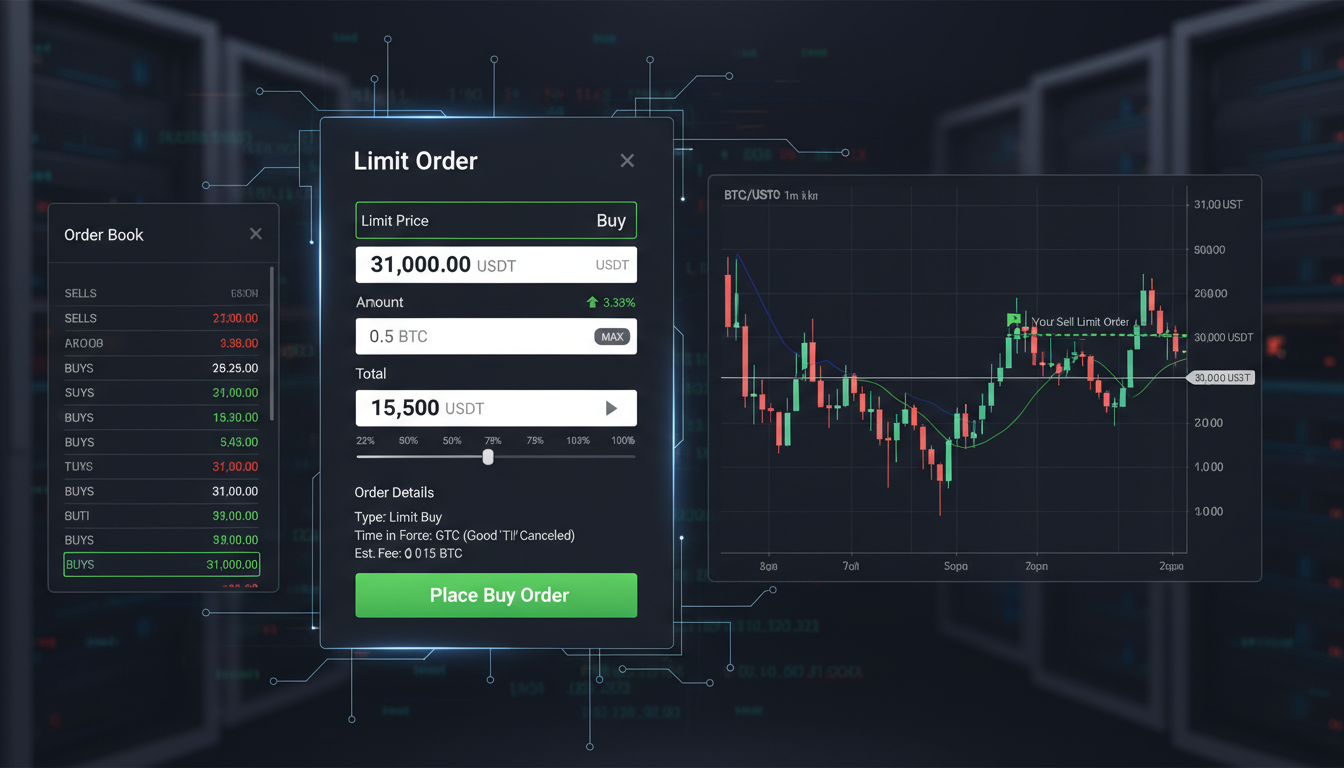

Use Technical Tools Too

Support and resistance, volume profiles, moving averages—they all help map possible entry or exit zones. Especially useful when speculation is ramping up.

Conclusion

The next crypto bull run isn’t a mystery. It’s gradually forming in plain sight—fed by easing monetary policy, clearer regulation, and tech progress. Analysts expect an early stir possibly in the coming months, with the full surge taking shape into 2026. But caution is needed: markets remain volatile, cycles unpredictable, and sentiment fickle.

Clarity from regulators, institutional capital, and continued innovation offer strong tailwinds. Still, successful timing requires watching macro cues, policy shifts, and tech developments. If those align, the next bull run may not just happen—it could stick around.

FAQs

What are analysts saying about when the crypto bull run will begin?

Most expect the start in the next few months, conditional on macro improvements and regulation clarity. A stronger rally might unfold through late 2025 and into early 2026.

Which factors will drive the next bull run?

Key drivers include monetary easing, growing regulation clarity, institutional capital entering, and continued innovation in blockchain tech.

Can institutional interest really make a difference?

Yes. Institutional players bring scale and confidence. Their entry often prompts broader investor participation and can contribute to sustained price trends.

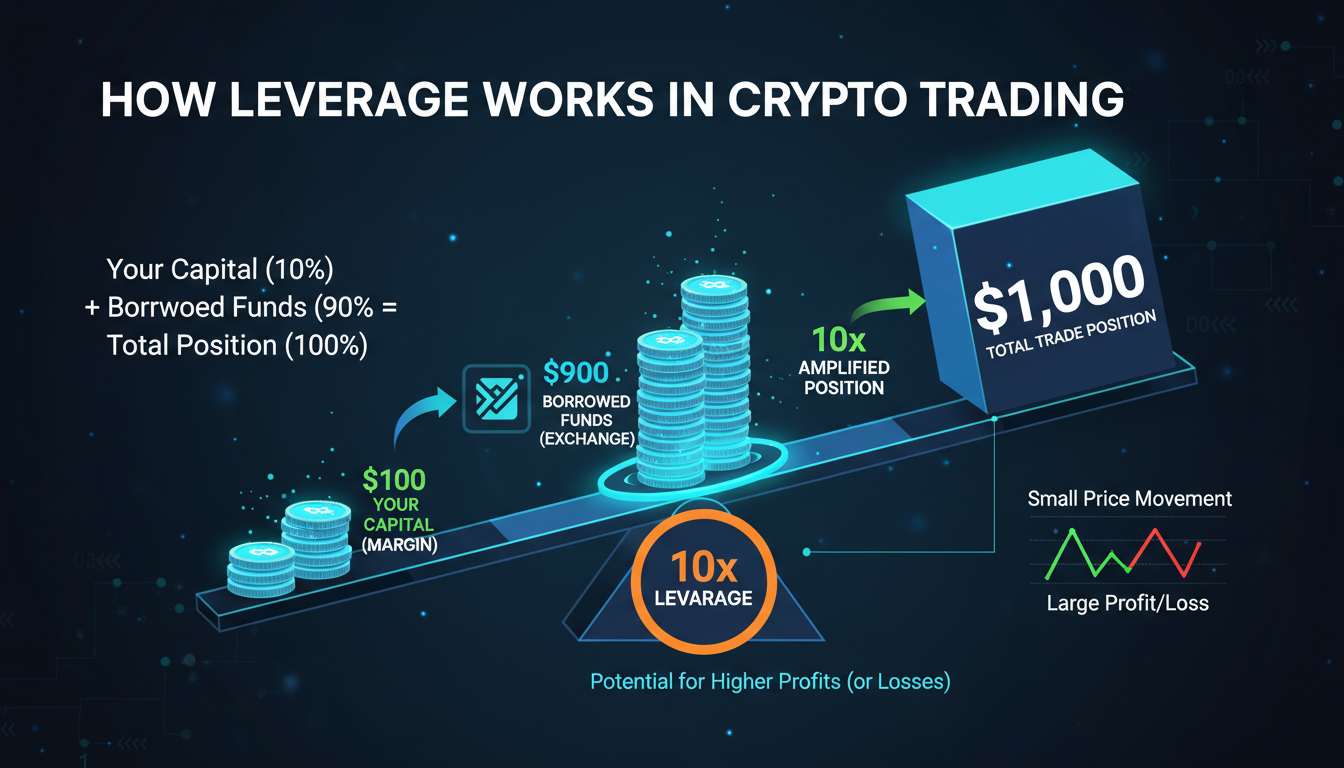

Are there risks that could derail the bull run?

Absolutely. Potential pitfalls include regulatory setbacks, macro shocks, tech disruptions, or speculative bubbles that crash quickly.

How can retail investors prepare?

Stay informed on macroeconomic data, regulatory updates, and market sentiment. Using technical analysis and staying moderate with allocations can help manage risk while participating.

This took a natural, direct tone—and I hope it helps you get what analysts expect for the next surge.