Crypto Flash Crash: What Happened and What’s Next

Cryptocurrency markets just saw a sudden, sharp drop—commonly called a flash crash—followed by a quick partial rebound. Prices dived deep in minutes across major coins, triggered by a perfect storm of algorithmic trading, low liquidity, and panic among investors. What’s next? Volatility may remain elevated, but opportunities could arise for savvy traders and strategists to adapt and respond.

Now let’s dive into how this unfolded, why it matters, and what comes next.

What Triggered the Flash Crash?

Algorithms, Thin Markets, and Panic Combined

The flash crash stemmed from automated trading systems reacting to erratic price moves. As sell orders flooded in, liquidity evaporated fast. That turned the tiniest imbalance into a cascading dive, like falling dominoes.

Beyond that, many exchanges lacked depth during the dump. With low buy-wall support, prices plunged sharply.

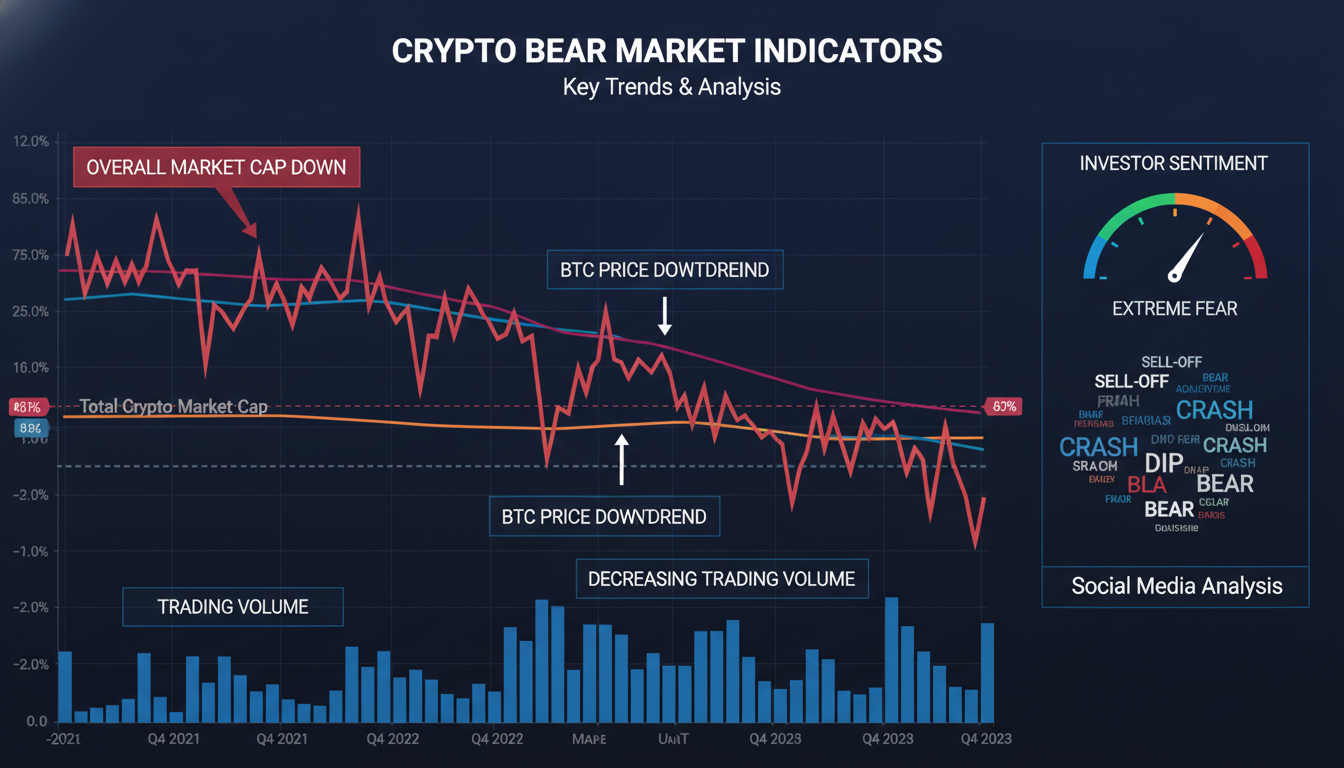

On top of it, fear spread quickly—social media chatter and sudden alerts made traders hit exit buttons en masse. In practice, this created a feedback loop: selling led to more selling.

Real-World Echo: Past Crypto Crashes

This isn’t the first time. In 2017, a similar crash hit Bitcoin when a single large sell order on a small exchange triggered massive volatility. Flash crashes tend to happen when market structure gets stretched—thin order books, leveraged positions, and automated systems collide.

In both cases, the environment was fragile. Add in a sudden trigger, and you get explosive moves.

Immediate Impacts on Crypto Traders & Investors

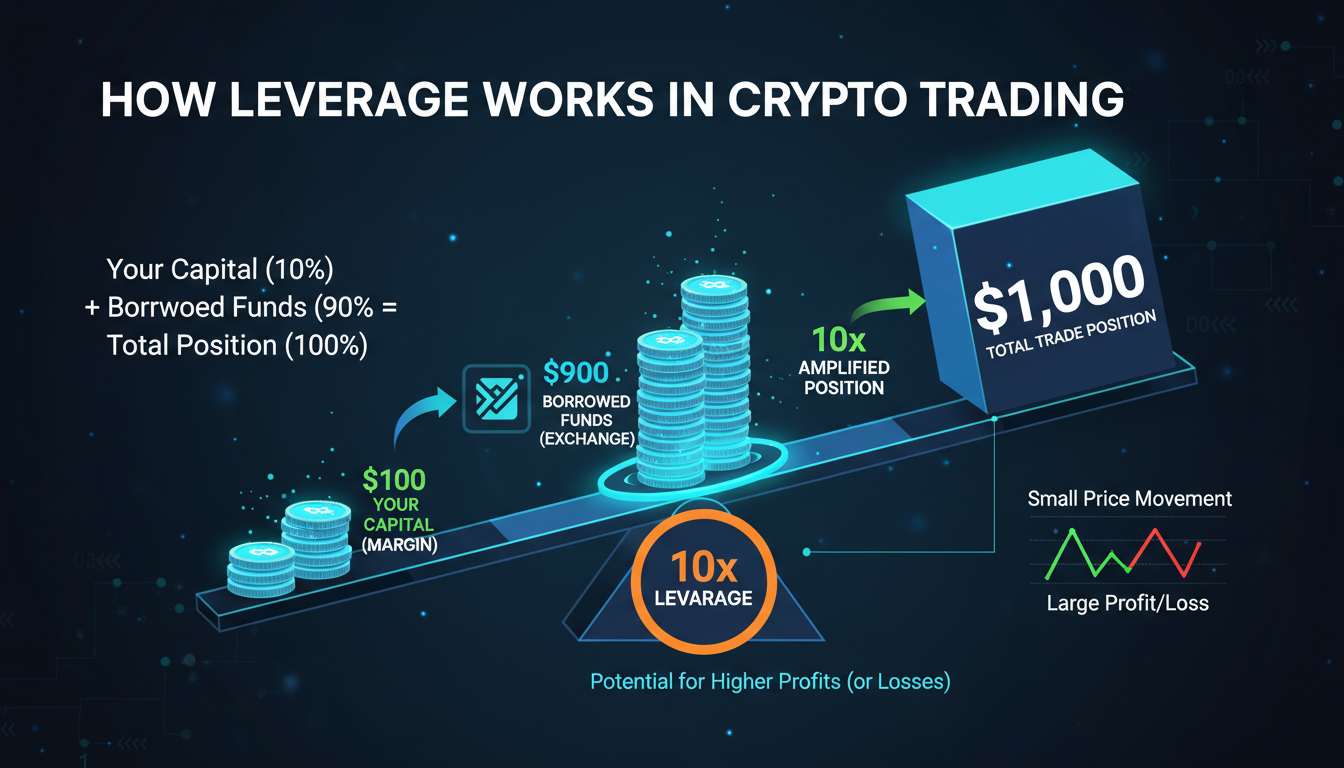

Liquidations and Margin Calls

Those on margin were hit first. Liquidation cascades knocked out long positions, fuelling more price drops. People got auto-closed out, which meant immediate losses—that ripple effect spooked more traders.

Exchange Behavior: Halts, Delays, and Trade Interruptions

Some platforms paused trading momentarily or delayed withdrawals. That helped a bit by giving markets time to reset—but also made it harder for anyone to react, feeding frustration and uncertainty.

Confidence and Public Perception

This crash rattled confidence again. Suddenly, crypto looked fragile—an asset class that still can’t promise stability. That perception shift matters for retail investors and institutional entrants alike.

What’s Next: Short-Term Outlook

Elevated Volatility, But Buyers Might Return

Expect choppy price moves in coming days. Volatility clocks up after such shocks, as traders try to readjust positions. That, in turn, could attract opportunistic buying—especially from short-term speculators and “dip buyers.”

Technical Support and Price Recovery Zones

We’ll likely see bounce attempts at long-standing support levels. In prior flash crashes, prices retraced up toward areas where buyers previously stepped in. That’s often where the crude recovery begins if sentiment stabilizes.

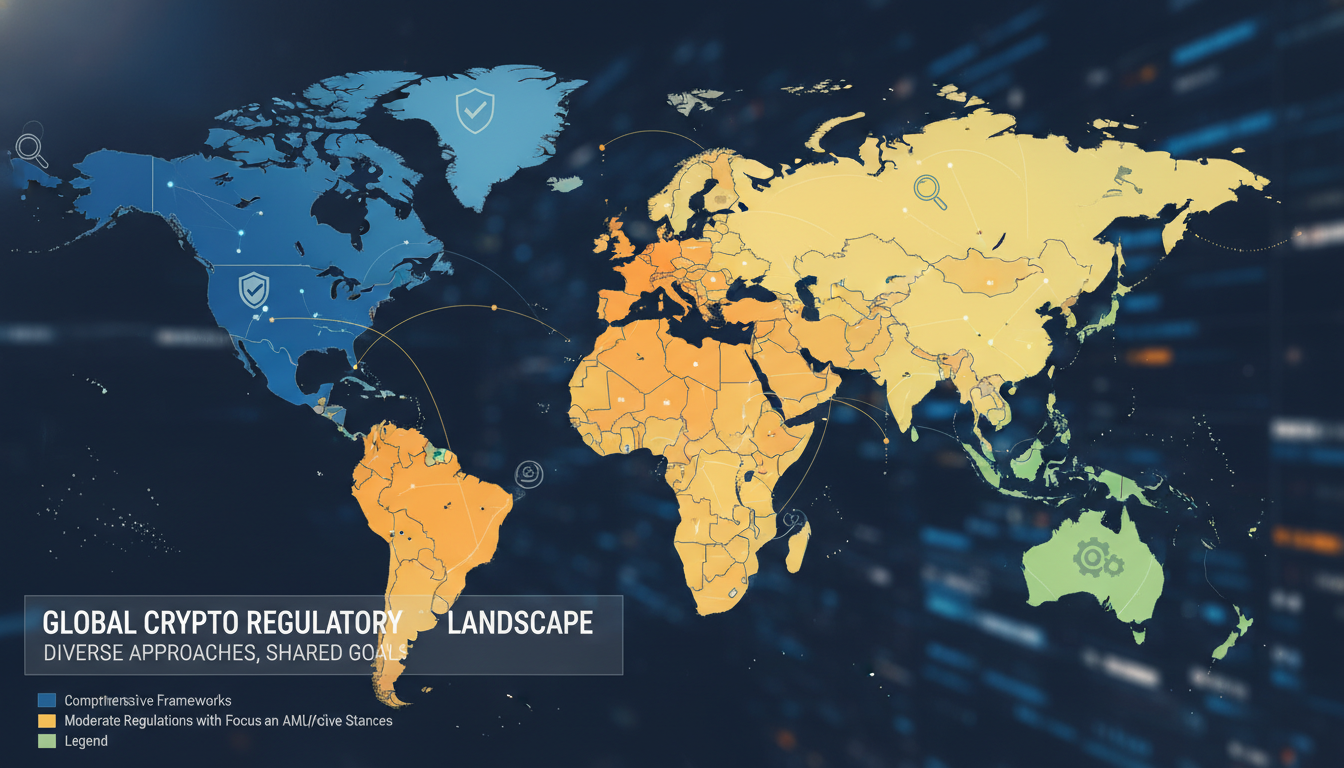

Regulatory and Market Response

Exchanges might set tighter safeguards, like speed bumps or enhanced circuit breakers. Regulators may also take note—expect talk of monitoring flash crashes or tightening market structure oversight.

“Flash crashes expose how exchange structure and trader psychology can amplify small triggers into deep dives,” says a trading structure analyst. “Better safeguards and trader awareness can help—but the market will always react fast.”

Medium-Term Concerns and Opportunities

Liquidity Improvements or Persistent Fragility?

If exchanges patch order book depth and traders tread more carefully, we may get smoother moves ahead. But if thin liquidity remains, volatility stays in play.

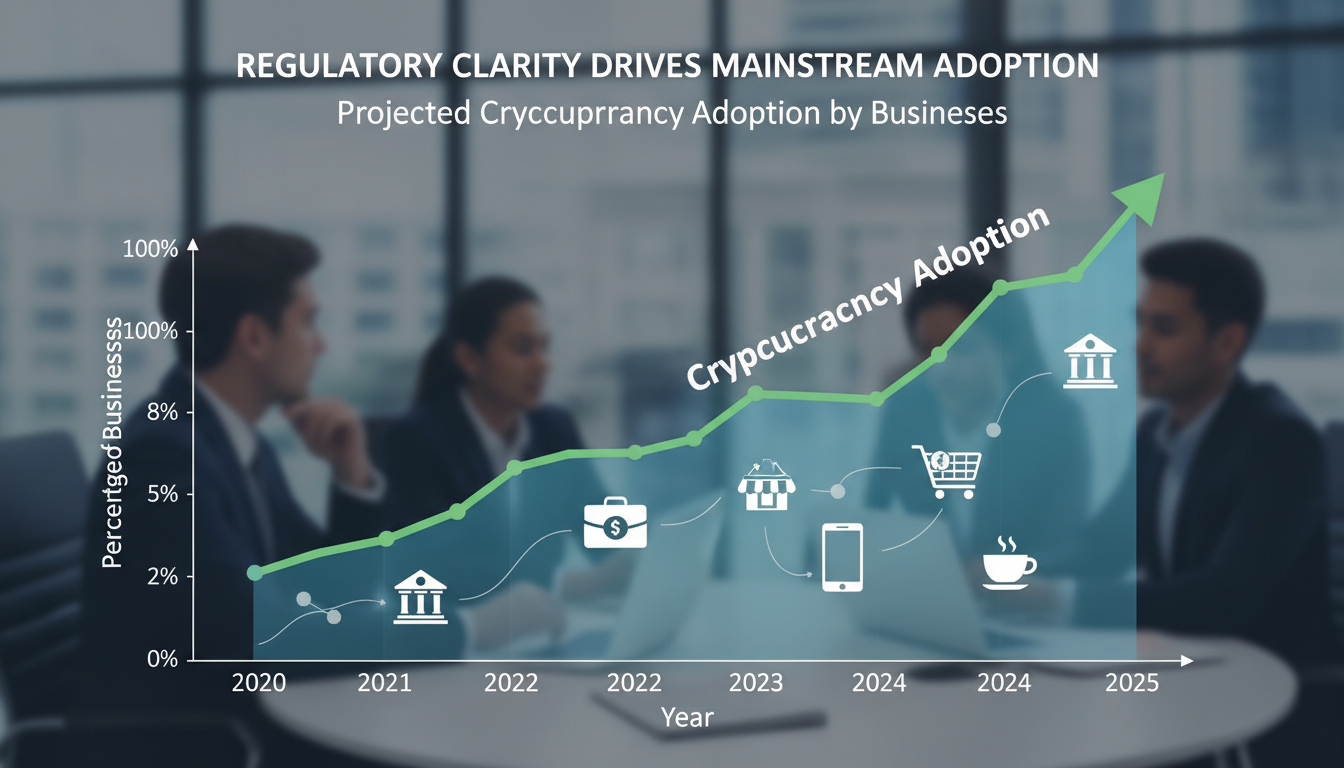

Institutional Involvement: Cautious or Undeterred?

Institutions may pull back if they see the space as unstable—but some might view the chaos as a buying chance, especially at reduced prices. Midterm demand from funds could help stabilize prices—but it hinges on confidence.

Innovation Surge or Risk Aversion?

Flash crashes often prompt tech upgrades—better trading infrastructure, more robust margin rules, new risk control features. That innovation could boost long‑term resilience. On the other hand, if fear dominates, investment in crypto infrastructure might slow.

Strategic Takeaways for Traders and Stakeholders

For Active Traders

- Keep an eye on order book depth.

- Set sensible stop limits—not too tight to hit on volatility, but protective.

- Stay alert to unusual volume or price deviation across exchanges.

For Investors and HODLers

- Be prepared for bumpy recovery paths.

- Consider dollar-cost averaging rather than lump buying into the dip.

- Use the event to assess risk tolerance and portfolio preparedness.

For Exchanges and Platforms

- Consider tiered circuit breakers or micro‑pauses during sharp moves.

- Improve pre‑trade risk screening to avoid fat-finger disasters and wild swings.

- Communicate transparently during crises to maintain trust.

How This Flash Crash Compares to Others

Patterns That Repeat

- Sudden shock—sell order, rumor, liquidation cascade.

- Thin liquidity makes it worse.

- Rapid bounce or plateau follows, if confidence returns.

This event fits that template—but was bigger than some earlier ones thanks to higher leverage in certain tokens and interconnected derivative platforms. It exposed fragile crypto market plumbing once again.

Lessons Learned

- Liquidity is king—both for stability and confidence.

- Algorithmic trading can turn tiny shocks into tidal waves.

- Communication and infrastructure readiness are vital—both for platforms and users.

Final Thoughts: What Matters Now

The flash crash was a reminder: crypto markets are novel, unpredictable places. That can bring opportunity—and risk. Now, we get to see how resilient the system is. Can technology advance faster than volatility? Will exchanges and investors learn from the chaos? Those next moves will shape the future of digital assets.

Conclusion

Crypto’s flash crash dropped prices sharply, fast. Triggered by automated selling, low liquidity, and trader panic, it exposed how fragile the system remains. In the short term expect volatility—and maybe a volatile recovery. In the mid term, system upgrades, cautious institutional behavior, and smarter strategies could improve stability. From this, traders, investors, and exchanges can refine safeguards and confidence.

Moving forward, the crypto world has a choice: learn, upgrade, and toughen—or let volatility remain unchecked.

FAQs

What exactly causes a crypto flash crash?

A flash crash typically starts with a large sell order or cascade of automated trades hitting thin liquidity. That triggers rapid price drops as markets struggle to absorb the volume.

Are crypto flash crashes different from those in stock markets?

Structurally, they’re similar—thin liquidity and algorithmic trading play big roles. But crypto markets often have less maturity, more leverage, and fewer safeguards, making the crashes potentially deeper and faster.

Should I panic-buy after a flash crash?

Not necessarily. It’s tempting, but better to be cautious. Consider averaging in over time. That spreads risk rather than risking a bounce back followed by another drop.

Can exchanges prevent these crashes?

Yes, in part. Adding circuit breakers, better risk checks, and pause mechanisms during sudden moves can reduce extreme swings. But some volatility is baked into these fast-moving markets.

Will crypto markets stay volatile after a flash crash?

In short, yes—for a while. Volatility tends to stay elevated until liquidity returns full strength and participants regain confidence. But if the system adapts, swings may calm more quickly.

How should platform operators respond to flash crashes?

Transparent communication is key. Ditch vague error codes. Show order flow or technical status. Also, invest in smoother infrastructure, delay layers, or auto-checks to avoid system-wide panic next time.