Jerome Powell has sent several key policy signals regarding crypto: he firmly rejects a U.S. central bank digital currency (CBDC) during his term, supports stablecoin regulation, is concerned about “debanking” in crypto, encourages a regulatory framework via Congress, and hints at more flexible monetary policy that might ease conditions for digital assets.

Powell Rules Out Fed-Issued Digital Dollar

In a 2025 Senate hearing, Powell was asked directly if he would commit to never launching a central bank digital currency while chair. He replied “yes”—underscoring his firm stance against a federal CBDC for now. This puts to rest recurring speculation, even though the Fed has considered the concept for years .

He emphasized that FedNow—a real-time payments system—is the practical tool for addressing payment needs, not a digital dollar .

Support for Stablecoin Oversight, Debanking Concerns

Powell has shown openness to stablecoins and concerns related to crypto access. He noted stablecoins “may have a big future,” emphasizing the need for a regulatory framework that protects consumers and savers .

He also voiced concern over debanking—when banks cut off legal crypto companies—saying the Fed would reassess its supervisory manuals to address risk-averse behavior .

Urging Congress to Build Crypto Regulation

Powell highlighted that while the Fed doesn’t oppose innovation, banks should not drop legitimate crypto clients due to over-cautious risk avoidance .

He urged Congress to move forward on a regulatory apparatus for crypto. He emphasized the Fed has already engaged lawmakers to help build a clearer framework .

Monetary Signals and Their Impact on Crypto

Powell’s tone on monetary policy often sways the crypto markets. In a recent speech, he signaled a meeting-by-meeting approach and hinted that quantitative tightening might soon end—raising hopes for easing conditions .

Markets responded with cautious optimism: digital assets saw mild gains as the path appeared less stringent .

Historically, even a subtle hint at rate cuts triggered crypto rallies. Back in August 2025, when Powell opened the door to easing, Bitcoin and Ethereum jumped notably .

Why All This Matters for Crypto Markets

- No CBDC means continued relevance for private digital currencies. Investors and innovators can breathe easier knowing Powell won’t launch a Fed-backed coin.

- Stablecoin regulation guidance creates legitimacy. Saying they may have a “big future” signals institutional interest could rise.

- Banks can serve crypto clients—if rules are clearer. That could ease compliance worries and integrate digital assets into traditional finance.

- Flexible policy helps liquidity-sensitive assets like crypto. Shifting away from aggressive tightening may curb volatility and support price stability.

Real-World Context

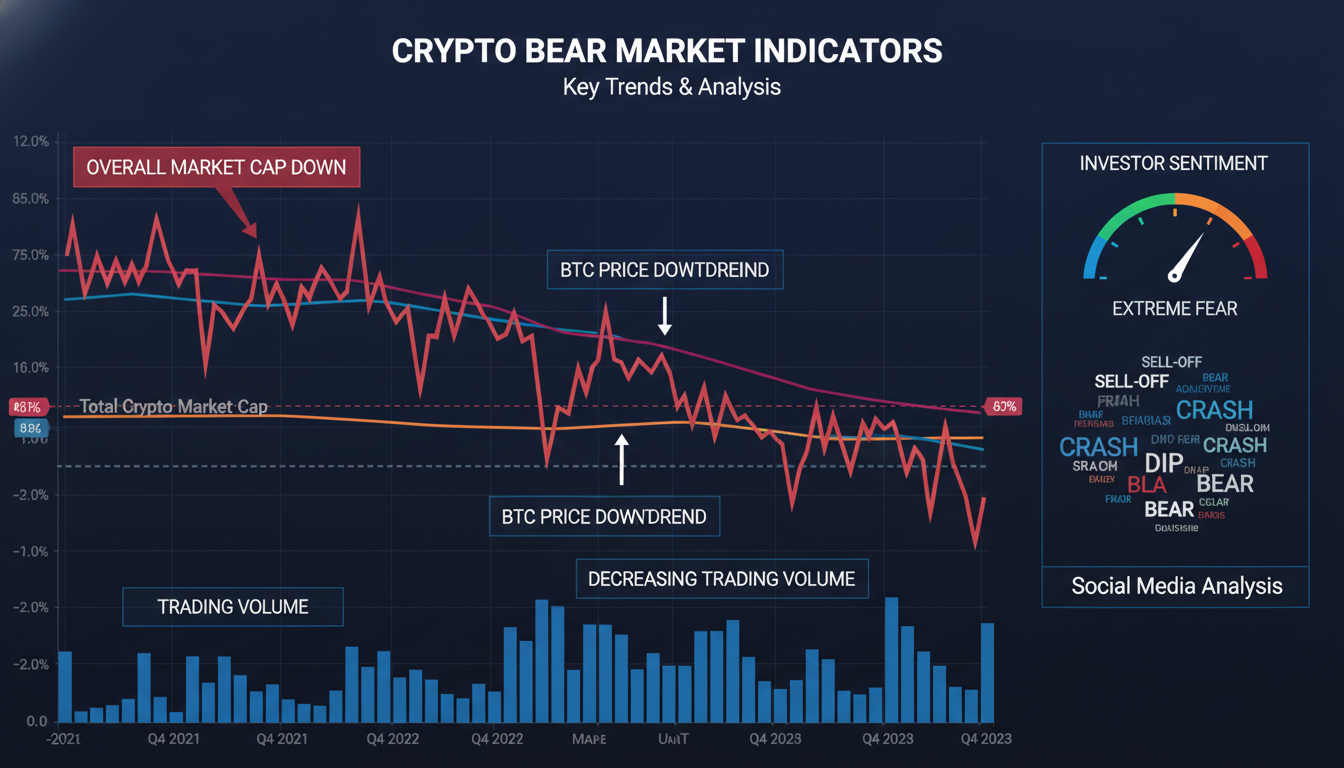

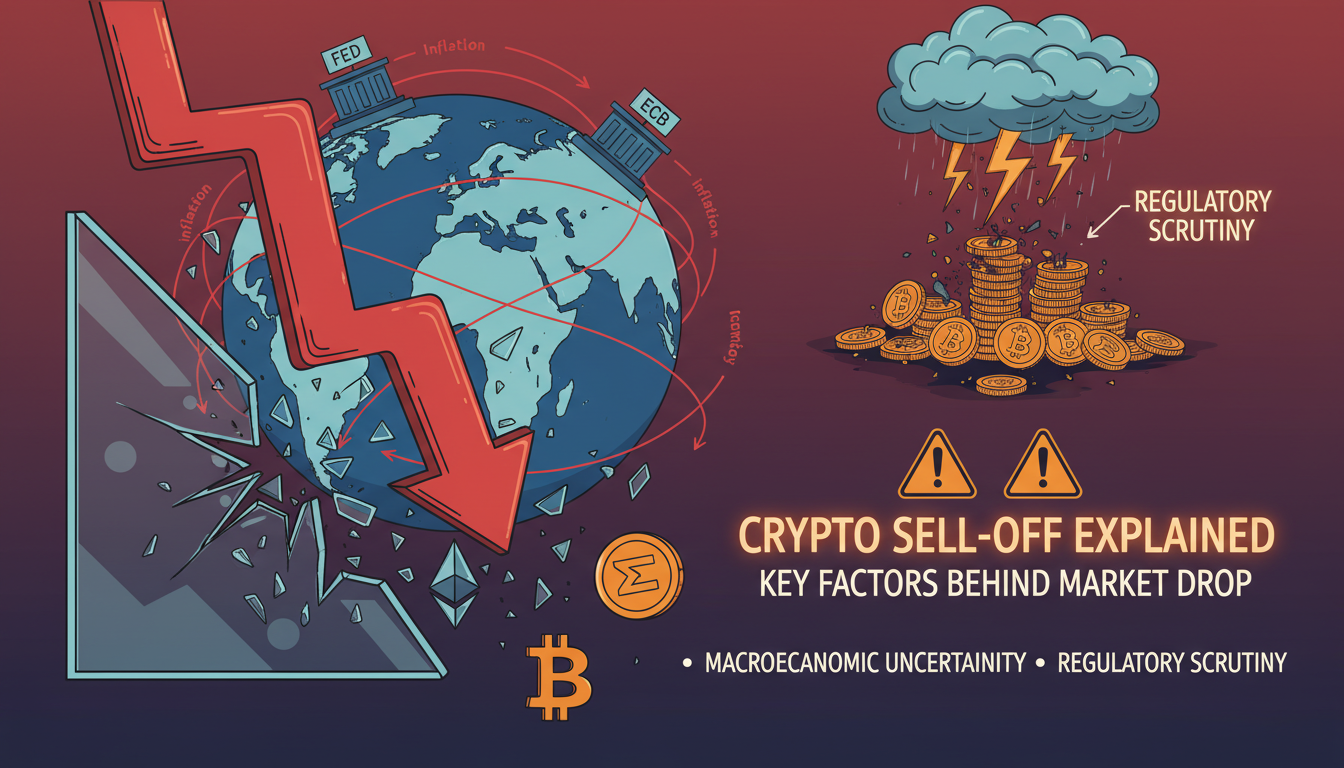

Crypto markets are reactive. For instance, just days ago markets fell sharply amid broader uncertainty and regulatory ambiguity. Analysts tied part of the pressure to Fed’s hawkish tone, despite recent rate cuts—underscoring how Powell’s stance weighs heavily on digital assets .

Conversely, when Powell expressed flexible policy posture, markets breathed easier. Institutional inflows into crypto ETFs surged—$588M into Bitcoin ETFs and $71M into Ethereum—suggesting growing confidence tied to Fed commentary .

“Stablecoins may have a big future,” Powell said, stressing they must develop safely and with consumer protection.

That kind of remark matters—it signals central bankers see Crypto not just as a fringe experiment but something worth integrating carefully.

Conclusion

Powell’s policy signals shape the crypto landscape in tangible ways. His rejection of a Fed CBDC preserves space for private digital currencies. Encouragement of stablecoin regulation and his concern about debanking help legitimize the industry. Calls for congressional action give direction that policymakers may act. Meanwhile, his nuanced approach to monetary policy quietly supports better liquidity for crypto. Taken together, these signals—while not dramatic—are meaningful. They suggest a path toward gradual integration, risk-aware regulation, and institutional comfort that can stabilize and propel the digital asset market forward.

FAQs

What did Powell say about a Fed digital dollar (CBDC)?

He committed not to launch a CBDC during his term, saying the FedNow system already addresses payment needs .

Does Powell support crypto or stablecoin oversight?

Yes—he views stablecoins as having a potential future and supports building a safe regulatory framework .

Is Powell worried about banks dropping crypto clients?

He acknowledged “debanking” as a concern, and the Fed is revising its supervisory policies to reduce undue risk aversion .

Will crypto regulation come from the Fed soon?

Not directly. Powell urged Congress to establish a regulatory framework and said the Fed has been working with lawmakers on that .

How does Powell’s stance on interest rates affect crypto?

His flexible, data-driven approach to rate cuts or balance sheet policy tends to ease liquidity pressures—this often translates into crypto market gains .

Did institutional investors respond to Powell’s signals?

Yes, after he signaled growing institutional acceptance, crypto ETF inflows surged: nearly $588M into Bitcoin and $71M into Ethereum .