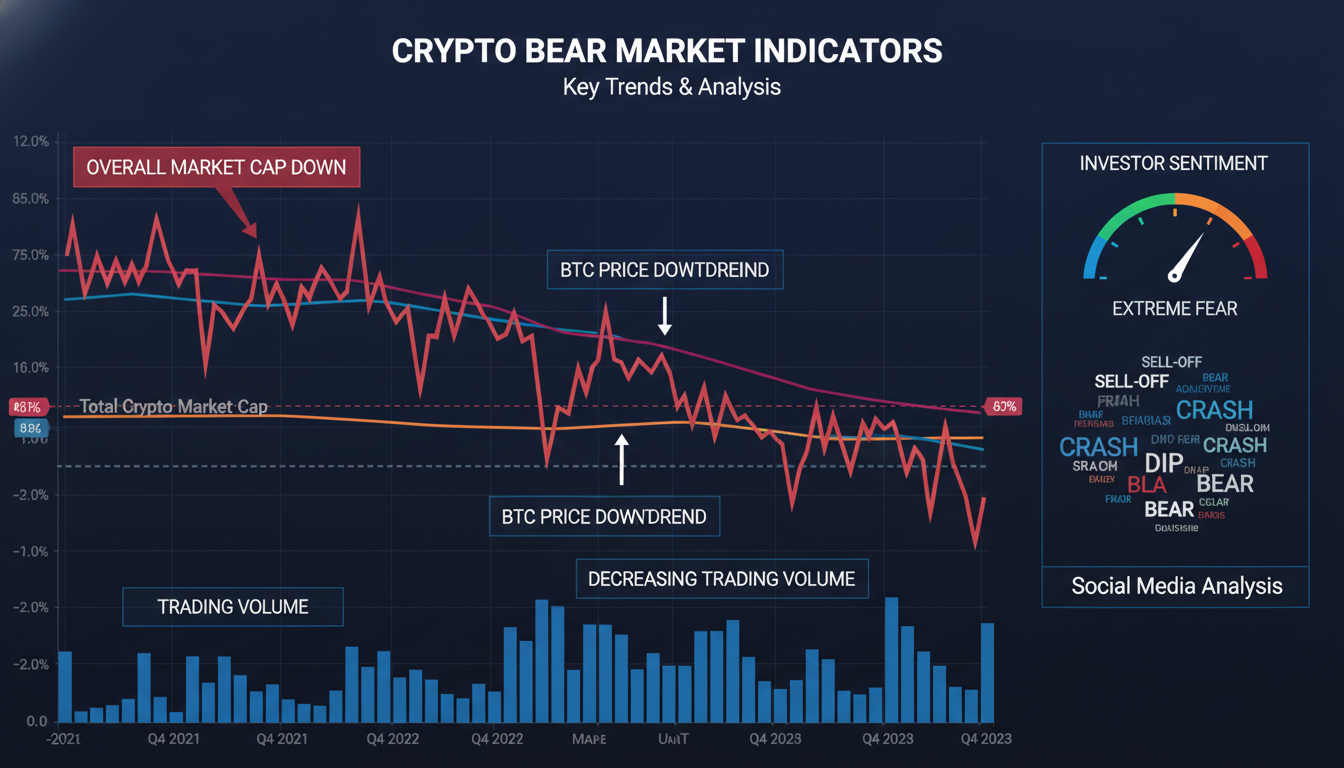

Crypto shows signs of bouncing back with cautious optimism. Market sentiment has thawed after drawn‑out downturns, and several indicators suggest a possible recovery in the coming months. Investors see improving on‑chain metrics, renewed institutional interest, and more favorable macro trends. Still, volatility remains the name of the game—gains may come in fits and starts. Let’s unpack what’s really going on.

Market Signals Hinting at a Turnaround

Even in rough patches, crypto markets often bounce from oversold territory. Here’s what’s fueling a bit of hope:

- On‑chain activity has ticked up—wallets are awakening, transaction volumes are stabilizing, and addresses holding coins long‑term are growing. Those patterns usually precede renewed traction.

- Institutions are trickling back. Whether through ETFs, futures, or custody services, big players aren’t retreating completely, and their re‑entry tends to boost confidence.

- Broader finance is shifting. With inflation easing and central banks pausing rate hikes, riskier assets like crypto could benefit from renewed appetite.

Still, sentiment is fragile. Headlines and large trades can swing the market fast. Recovery may be slow, messy, and fraught with wild ups and downs.

What Could Spark Crypto’s Next Rally?

To piece together how crypto might climb again, consider key catalysts:

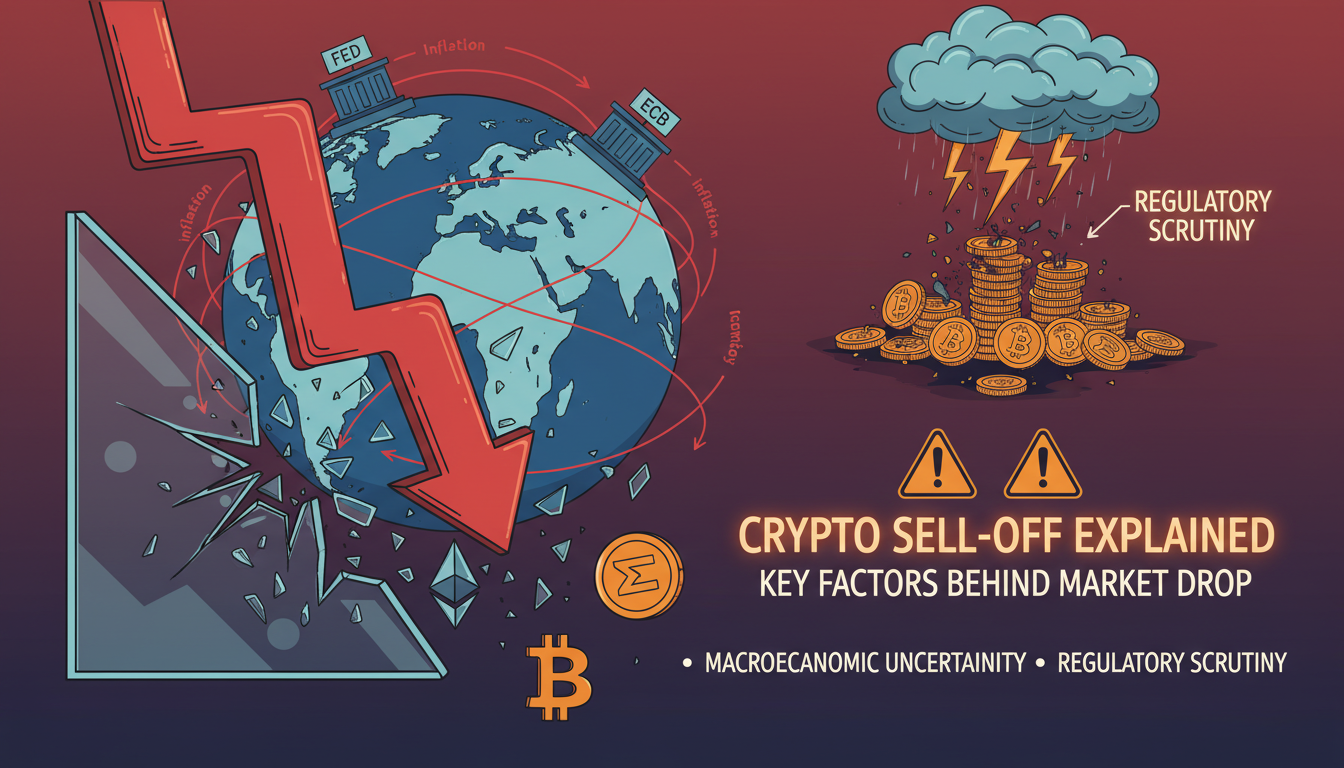

Macroeconomic Tailwinds

As central banks signal rate cuts or policy easing, liquidity tends to flow back into speculative assets. Crypto has historically gone along for the ride.

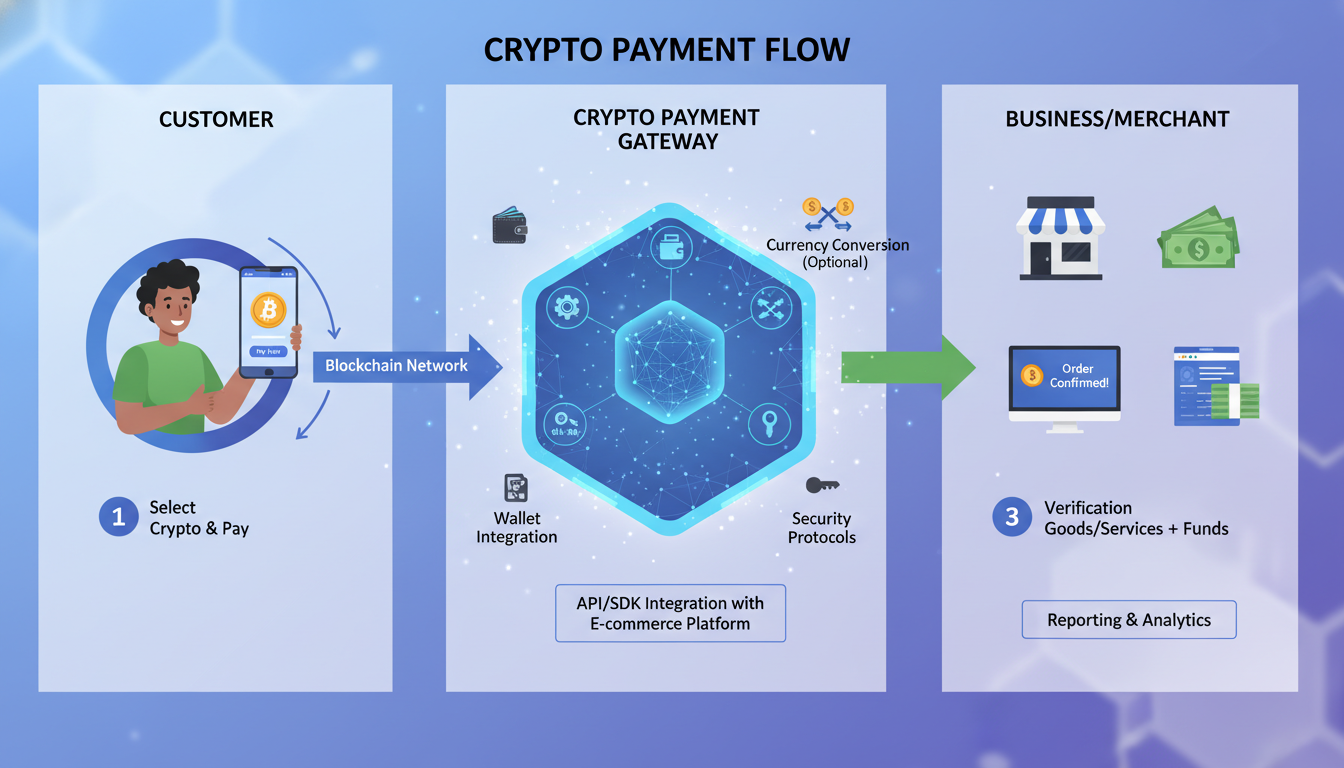

Institutional Money and Products

Launches of new ETFs, custody platforms, and regulated financial products ease friction for big investors. That access often correlates with price rallies.

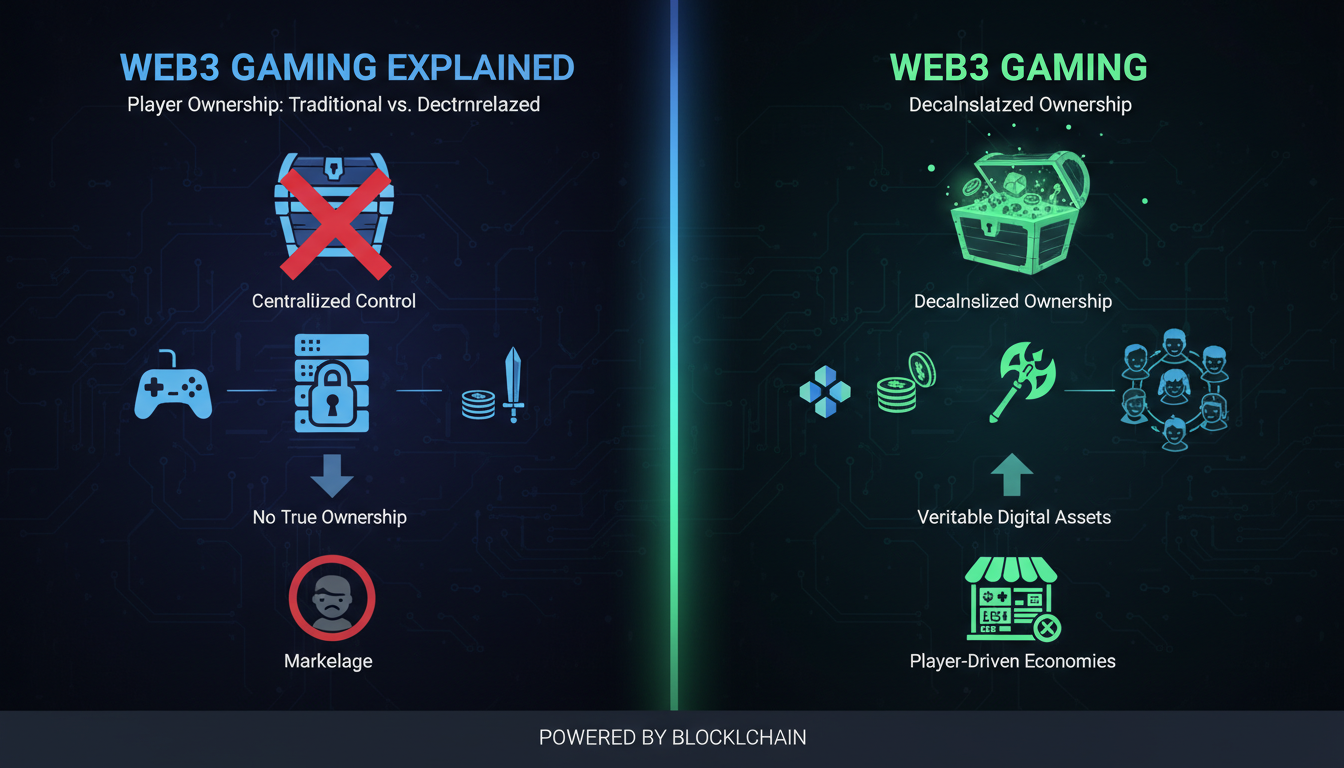

Tech Developments and Use‑Cases

Upgrades like Ethereum’s sharding, rollups, and cross‑chain tools improve scalability and utility. Real-world apps—whether NFTs, payments, or DeFi—make crypto more relevant, attracting fresh demand.

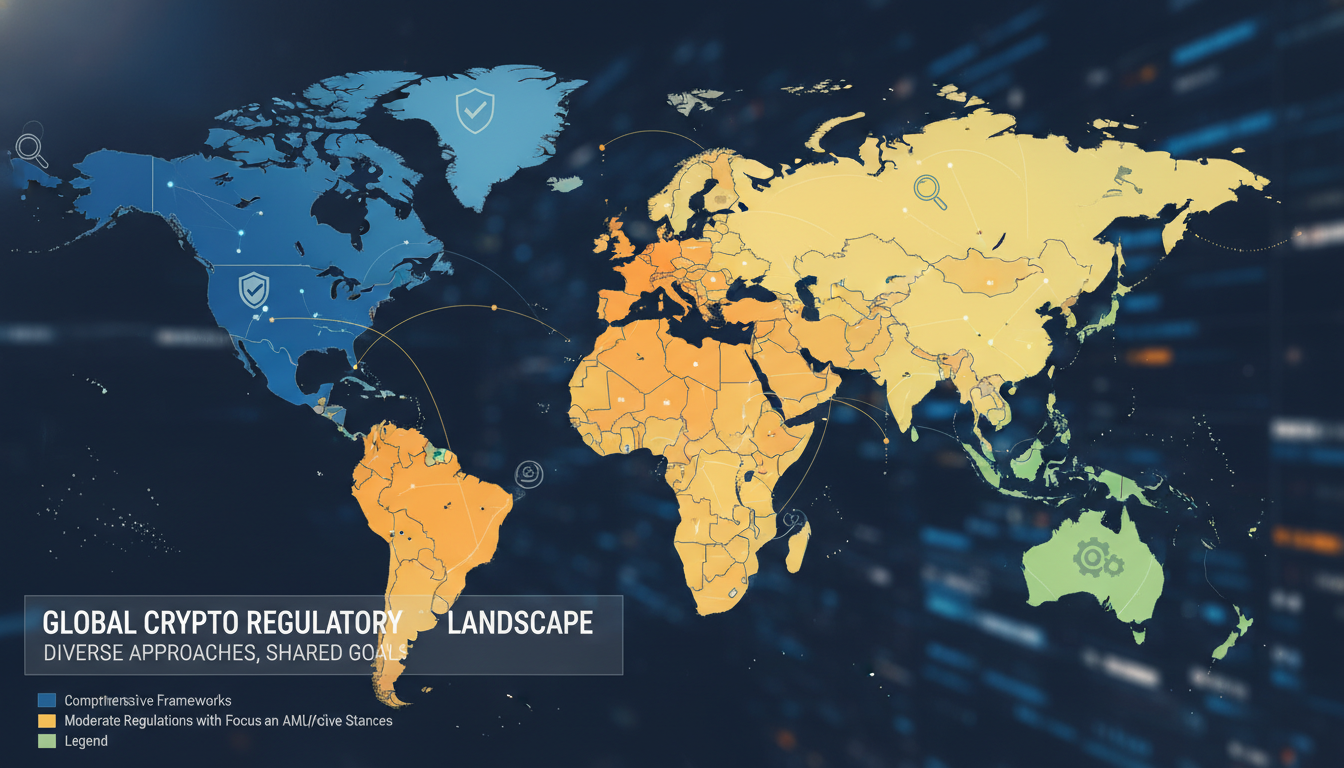

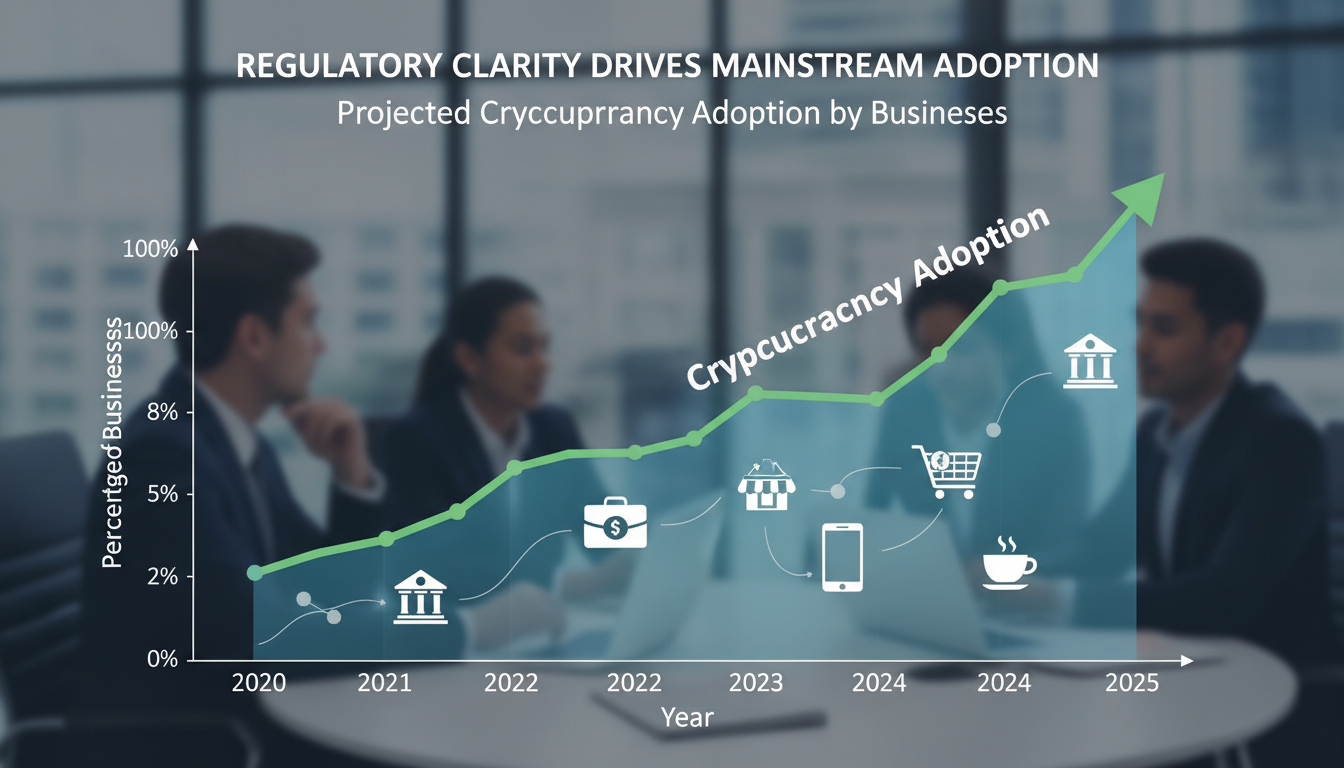

Regulatory Climate Maturation

Clarity on crypto rules—especially in major markets—reduces uncertainty. As regulation becomes clearer, hesitant investors may unwind from the sidelines.

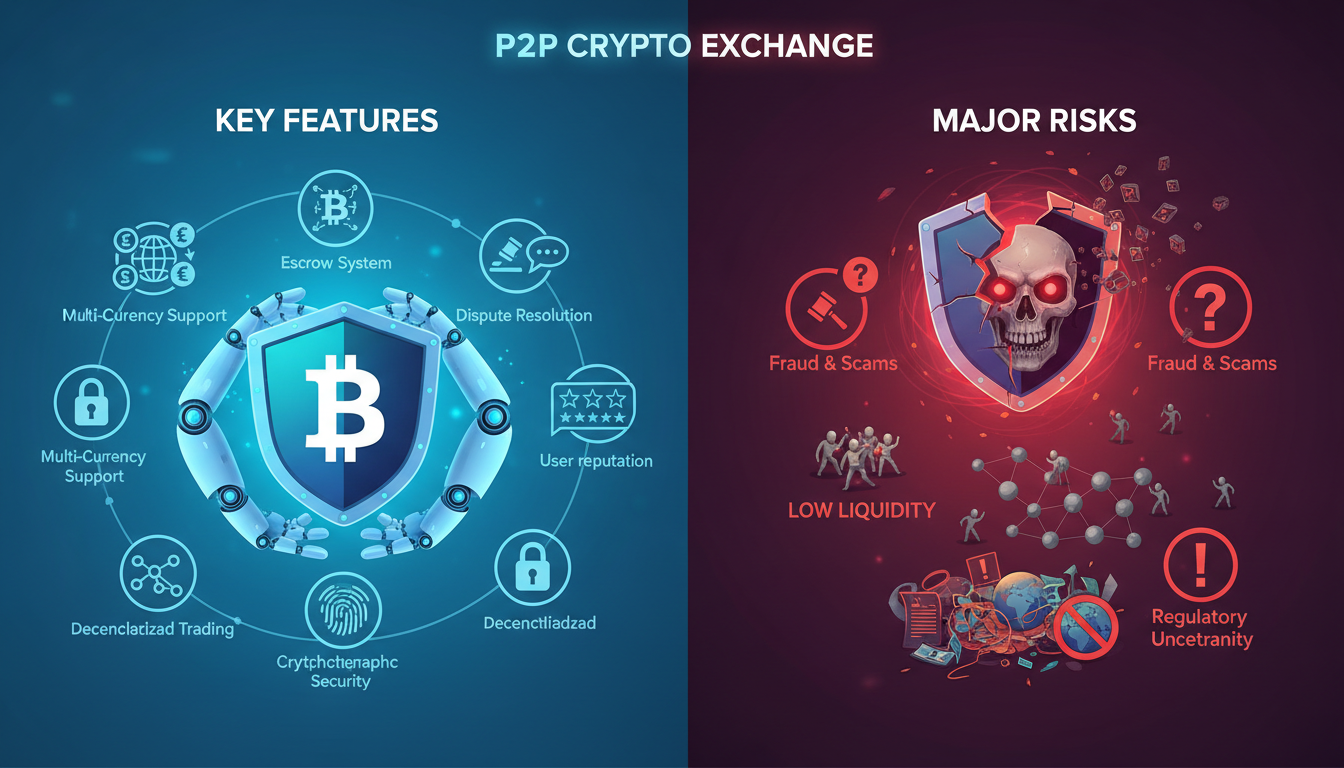

Traps and Risks on the Road Back

Recovery isn’t guaranteed. Along with upside, these risks still loom large:

- A market dominated by hype remains prone to sharp losses on bad news.

- Regulatory crackdowns or shifting political winds could stall or reverse recovery.

- Slow adoption in real‑world use cases may leave prices untethered from actual value.

- If large holders—like whales or insiders—sell, that could trigger sharp dives.

Understanding these pitfalls helps keep expectations grounded. Crypto rebounds fast—but plunges can be faster.

Example: Bitcoin Bounce vs. Ethereum Fundamentals

Take Bitcoin’s last dip. When conviction picked up, BTC surged double‑digit percent over a few weeks, driven by renewed demand from big funds. Meanwhile, Ethereum’s upgrades—like the Merge or rollups—slowly built confidence, even if price gains lagged initially. Recovery often plays out in fits of volatility, powered by both sentiment and substance.

“Crypto markets recover when fundamentals align with investor confidence,” says a seasoned trader. “You need both angles—real use‑cases and belief in the future.”

What Investors Should Keep Watch On

Here’s what to track if you’re waiting for a bounce:

| Indicator | Why It Matters |

|—————————|————————————————–|

| On‑chain metrics | Rising activity signals renewed interest |

| ETF/share inflows | Institutional money can shore up prices |

| Regulatory clarity | Reduces fear, opens the door for broader demand |

| Upgrade/development news | Tech improvements build long-term credibility |

| Macro trends & liquidity | Fed policy and sentiment shape speculative flows |

Strategic Outlook: A Sequenced Recovery

Recovery feels more like a stair‑step pattern than a straight climb. You might see:

- Sentiment‑led #mini rallies from spillover in equity markets.

- Upticks driven by new financial products or institutional re‑entry.

- Broader moves as tech and regulatory clarity come together, laying deeper groundwork for a more sustainable uptrend.

If broader markets stay steady, institutional legs return, and real‑world crypto use keeps growing, the next leg up could be meaningful.

Conclusion

Recovery is possible—and parts of the market already show green shoots. But dusty by short‑term volatility, fraught with uncertainties, and sensitive to macro forces. Still, indicators like on‑chain health, institutional flows, tech upgrades, and clearer regulation suggest that a more sustained bounce may lie ahead. Keep expectations realistic, watch data closely, and don’t be surprised if gains come one step at a time.

FAQs

How soon could crypto recover?

Recovery might begin in weeks or stretch over months. It depends on macro trends, sentiment, and institutional flows aligning.

What drives most of the bounce?

Often it’s a mix of improved sentiment and real developments—like growth in usage or clearer regulation.

Can regulation kill the rally?

It can trigger short‑term drops, but sensible regulation tends to boost long‑term investment and credibility.

Should I watch Bitcoin or Ethereum?

Both reflect broader themes: Bitcoin signals sentiment shifts, while Ethereum reflects functional growth in real‑world use.

Is this a good time to invest?

It could be—but only if you’re ready for volatility. Diversify, stay informed, and align with your risk tolerance.